Deep Dive: HEICO ($HEI $HEI.A)

HEICO is a serial acquirer of nice aerospace and electronic components businesses run by exceptional owner/operators.

HEICO is a serial acquirer of nice aerospace and electronic components businesses run by exceptional owner/operators. While the face P/E multiple is high, if you hone-in on FCF and the future organic and inorganic runway, the valuation today is fair to even slightly cheap depending on your M&A assumptions. With all the noise around tariffs, there may be an opportunity to buy shares at an attractive price. Berkshire Hathaway initiated on HEI.A in Q2 2024 around $150 to $180, which by my math is a mid-teens IRR. If you are going to punch a hole in that 20 hole punch card, HEICO is not a bad bet.

Overview

HEICO is a serial acquirer of aerospace MRO and niche electronics sub-components businesses. HEICO is led by Larry Mendelson (86) and his two sons Eric (59) and Victor (57) who collectively have a 16% stake. Since the Mendelson's took over in 1990, HEICO's Revenue, EBIT and Net Income have compounded at 16%, 19%, and 17% cagr, respectively, of-which approximately half has come from M&A. Shares have followed suit compounding 23% cagr over 34 years, dividends reinvested. While HEICO's businesses are exceptional on a standalone basis (25% EBITA margins, 43% returns on tangible capital), an investment in HEICO is ultimately a bet on the capital allocation abilities of the Mendelson family. Over the last 15 years, HEICO has redeployed 140% of FCF back into M&A whilst sustaining a 15% return on total capital.

HEICO has a decentralized organizational structure but is organized into two segments. HEICO's Flight Support Group (FSG) develops, manufactures and sells aftermarket aerospace components, known as PMA parts, into the commercial aerospace industry. FSG also has aerospace component repair, parts manufacturing and parts distribution businesses. HEICO's Electronic Technologies Group (ETG) develops, manufactures, and sells niche electrical sub-components into the defense, space, medical, and industrial end-markets.

HEICO has two share classes: The Common Shares ($HEI - 55m outstanding) and the A-Shares ($HEI.A - 84m outstanding). Class A shares have 1/10th the voting rights of Common and have historically traded at a 10% to 30% discount.

History

HEICO was founded in 1957 as Heinicke Instruments in Hollywood Florida and until 1974, was focused on manufacturing precision instruments for clinical labs. In 1974, HEICO expanded into jet engine replacement parts via the acquisition of Jet Avion. In 1989, HEICO sold its precision instruments business to focus exclusively on aerospace with specific expertise in engine combustion chambers.

In 1985, as a British Airtours flight began to take off, one of the Boeing 737 engines caught on fire. The pilot aborted and ordered an immediate evacuation, but by then the engine was spewing smoke into the passenger cabin. Ultimately, 55 of the 137 passengers died. Investigators later learned that a combustor on the engine had ruptured. Regulators subsequently mandated that combustors be changed at regular intervals, which previously wasn't required. Airlines were compelled to replace so many combustors that the part’s manufacturer, Pratt & Whitney (P&W), couldn’t keep up. More than half the world’s narrowbody fleet was grounded as a result. Airlines pressed P&W for a solution and P&W ultimately sent them to HEICO, which had acquired some of P&W's combustor drawings, and was authorized to make a generic combustor under a FAA program called Parts Manufacturer Approval (PMA).

In the 1960's, aftermarket or PMA parts were limited to simple components by the FAA like bolts, gaskets, and interior fittings, typically produced by small firms serving customers unable to source OEM parts for older aircrafts. The US Airline Deregulation Act in 1978 increased airline competition, pushing airlines to reduce costs, putting scrutiny on maintenance budgets. By the 1980s, PMA parts included more complex components like turbine blades and avionics. FAA's willingness to approve PMA parts was helped by the British Airtours incident along with concerns that older defence programs were facing parts shortages (miliary aircrafts stay in service longer than commercial aircrafts). Cash strapped airlines, especially those operating older fleets, began adopting PMA parts.

In the late-80's/early-90’s, Eric (recent graduate from Columbia) and Victor Mendelson (student at Columbia), were looking for inefficiently run publicly traded businesses that could be potential LBO targets using their family’s wealth. Their father Larry was a former accountant and Florida's largest condo developers who, as a side note, also went to Columbia and studied under David Dodd. When they analysed HEICO, they reasoned if they could get a PMA for a critical piece of the engine like a combustor, they could get it for other less critical pieces. The Mendelson's bought 15% of HEICO ($25m market cap at the time), secured four board seats after a proxy fight, and in 1990, Larry was installed as Chairman and CEO.

HEICO got approval for their second PMA part in 1991 and continued to focus on securing more PMAs and more business from the airlines, but the early days were hard. The FAA was deliberate in reviewing each new part HEICO developed, and P&W sued the company over the combustor IP. The suit was settled after a decade with minimal damage to HEICO. Over-time, the FAA grew comfortable with HEICO's replacement parts, as did customers, who realized HEICO could produce parts at a 30% to 50% discount to OEMs with no reduction in quality.

In 1997, to both ensure a supply of cheaper components and signal to OEMs that it didn’t like their high prices, Lufthansa Technik, one of the largest MRO companies wholly owned by Lufthansa, took a 20% stake in HEICO's PMA subsidiary. The seal of approval from Lufthansa allowed HEICO to gradually acquire new customers such as American, United, and Delta. Today, HEICO sells 20,000 parts (up from 2,500 in 2005) and holds approx. 50% share of the PMA market. Large customers buy $40m in parts annually.

While the original PMA business was and is an exceptional business, HEICO has proven itself to be an outstanding serial acquirer having done 103 deals since 1990 including expanding into electrical components for defence.

HEICO is run by Larry Mendelson (86, Chairman & CEO) and his two sons, Eric (59) and Victor (57). Eric runs the Flight Support Group (FSG) and Victor runs the Electronic Technology Group (ETG), but the Mendelson's run the entire company together. One of Larry's grandsons, David Mendelson, is also involved as VP of Acquisitions in FSG (c. 7 years working in various roles at HEICO, also went to Columbia). Larry is more finance orientated while Victor and Eric spend Mondays and Tuesdays travelling to visit subsidiaries and are more operationally orientated.

Larry Mendelson in 2020 Forbes Article

“All major decisions have to be unanimous. We will get together and one of us might not agree, but when we’re all done, it’s all worked fine.”

HEICO has pursued a decentralized model meaning HEICO leaves businesses alone as long as they are delivering to plan and only pursues light integrations case-by-case. HEICO believes decentralized business units, operated autonomously, ideally operated by original founders, are more entrepreneurial and more customer focused. Retaining management is a core part of HEICO's M&A strategy. About 80% of HEICO's acquired subsidiaries still have the original owner or management team running the business, often with a retained minority stake. While HEICO centralizes some corporate functions, enforces financial reporting standards across the organization, and facilitates collaboration where it makes sense, HEICO leaves the businesses to operate as independent entities. They are an "accumulator" under Scott Management's framework.

There is a good Business Breakdowns podcast with some more background.

Flight Support Group (68% of Revenue, 66% of EBITA)

HEICO's Flight Support Group (FSG) reports under three divisions but operates as c.50 autonomous businesses.

Aftermarket Replacement Parts (74% of FSG Revenue)

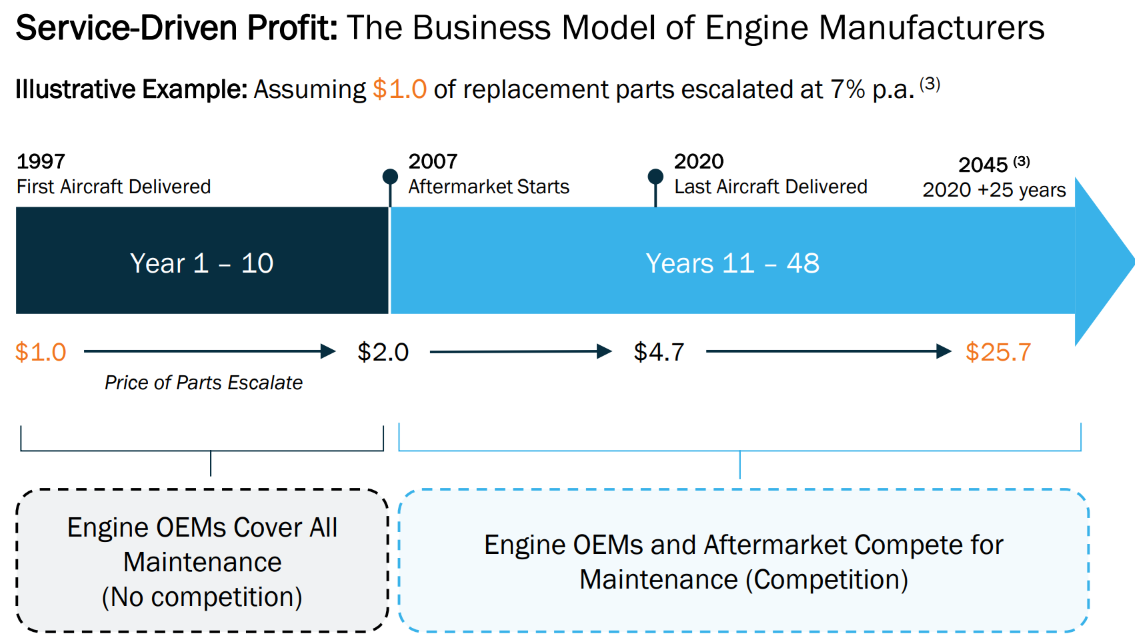

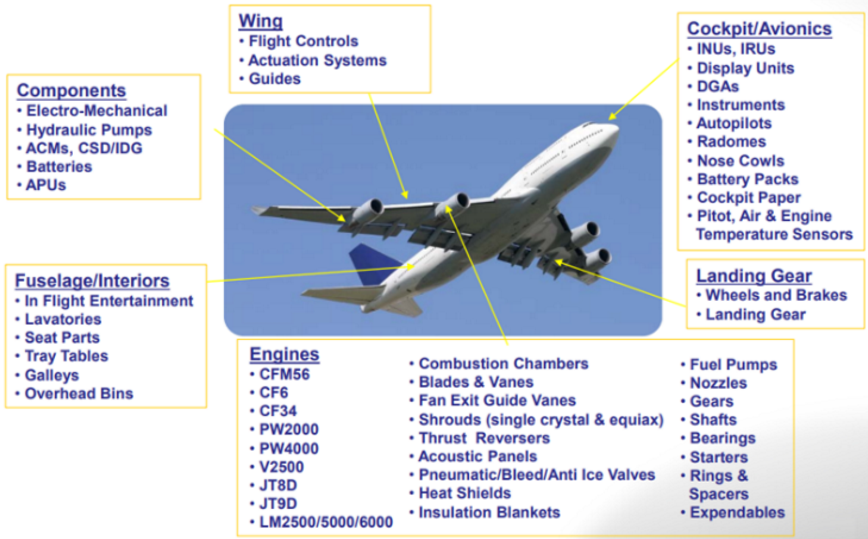

Background. When Boeing or Airbus design a plane, each individual part typically has one or two specified OEMs. A 737 can have 600k parts. Because a plane can have a 10 to 20 year production run then fly for 25 years, getting specified can lead to 25+ years of recurring parts revenue, with the parts supplier often having a monopolistic position as sole supplier (Boeing by this point doesn't care, it's the airline that pays the consequences). Therefore, OEMs often sell their initial component to Boeing or Airbus at a loss, knowing they have a multi-decade stream of captive high-margin aftermarket revenue from the airlines as components wear out or get replaced per regular schedules mandated by regulators. Engine OEMs for example can generate 5x the value of the original engine in parts revenue over the life of that engine as turbine blades, airfoils, seals, and bearings require regular replacement based on flight hours or cycles. For example, a CFM56, the workhorse of the global narrowbody fleet, needs an engine overhaul every 10 to 15 years and the cost of the first two overhauls can be comparable to the cost of the original engine. This slide from FTAI Aviation's investor presentation illustrate the business model, which assumes 7% pricing cagr which is a common long-term list price increase for MRO parts (large customers will get discounts). The illustrative part gets sold for $1 at production then eventually sells for $25.7 dollars at maturity.

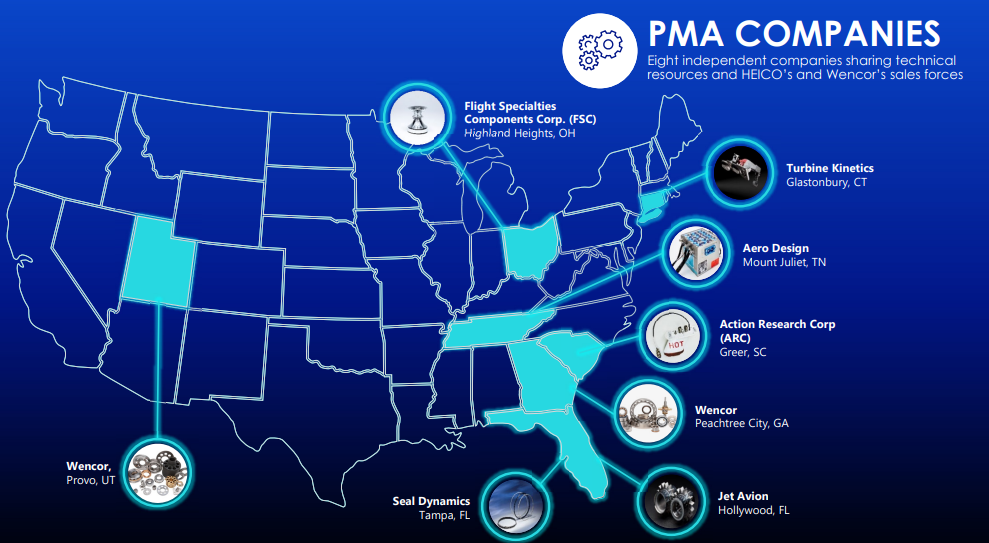

Division Overview. HEICO’s Aftermarket Replacement Parts division designs, manufactures, and sells PMA parts. This business is organized into 8 separate subsidiaries and has grown 18% cagr since 2014 which includes the 2023 $2.1bn acquisition of Wencor, the #2 PMA company and the largest acquisition in HEICO's history (more details later).

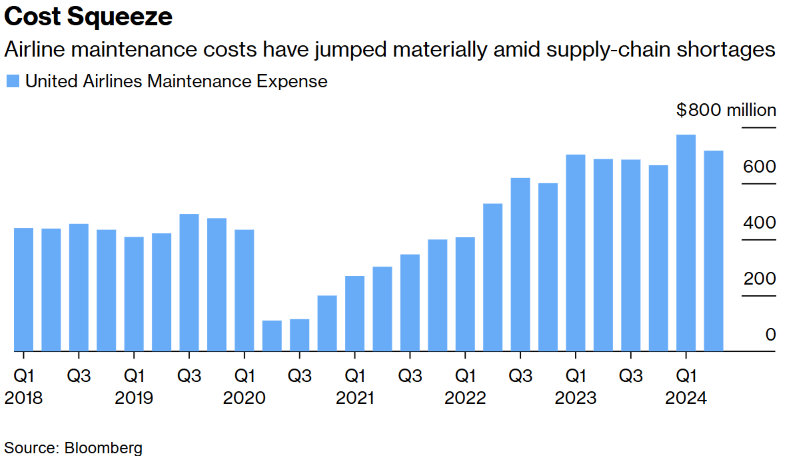

What are PMA parts? PMA parts are FAA-approved so by definition either meet or exceed the specifications of the OEM part and can range from highly technical components used in engines or landing gear to basic products such as seats, cupholders, and trolley latches. PMA Companies (PMACs) are not burdened by the upfront R&D costs and operating loss from the original part so can price their part 30% to 50% cheaper whilst still earning outstanding economics. Discounts are lower on complex metallic or composite parts but higher on parts like plastic interior components where engineering work is lower. For context, maintenance is 5% to 15% of revenue for an airline, which typically operates at LSD EBIT margins, so a 30% savings is significant. As the chart from Bloomberg shows, United spends upwards of $500m/quarter on maintenance.

Ivan Vallejo, Director of Supply Chain at Iberia Maintenance

Vallejo cited several advantages of PMAs. Since they are FAA-approved, he says they are safe and “as good as” OEM parts. According to Vallejo, cost savings range from 60-70% on fast-moving consumables, 20-30% on the total costs of a major repair of a component and 30-40% on engine airfoils, the most costly parts in engine overhauls.

Reverse engineering and manufacturing PMA parts is not easy as the part needs to mirror every single aspect of the original OEM part, including tolerance and metallurgical structure, which can be influenced by the materials used, manufacturing technique and chemical coatings. More importantly, it takes years for PMAC's to earn the trust of the FAA and airline maintenance departments. HEICO currently has 20,000 approved PMA parts and develops 500 to 650 parts every year. While cheaper PMA parts seem like a no-brainer for airlines, they only represent anywhere from 1% to 4% of the MRO market depending on your definition (HEICO cites 1% to 2%, TransDigm cites 1.5% to 2.5%, others cite 4%+).

Why is adoption low? There are several reasons.

- First is conservatism from airline maintenance departments. You never get fired for buying an OEM part and there is often IT work (updating the codes) and training (perhaps a different installation manual) associated with PMA adoption. If it were up to the CFO, PMA's would be no brainers but it is often up to the Head of Maintenance.

- Second is barriers from leasing companies. 40% to 50% of the aircraft fleet is leased and some leasing companies worry that having PMA parts will reduce the resale value of the plane as airlines, especially in Asia and MEA, don't accept PMA parts.

- Third, OEMs threaten to void warranties (illegal) or enter into 5 or potentially 10-year service agreements, sometimes called power-by-the-hour (PBH) contracts to lock-in maintenance revenue for the first 5 to 10 years of service. A PMAC's sweet spot is years 10 through 25 of a plane's life.

Given PMA parts are FAA approved, like-kind-like-quality and 30% to 50% cheaper, many of these barriers are fading as illustrated by the fact that the top 19/20 airlines are HEICO customers (Singapore Airlines is the straggler). In fact, within airlines with high PMA familiarity, PMA penetration can be as high as 12% and moving higher. COVID (and other crisis like the GFC and 9/11) was a major catalyst to PMA adoption as, in addition to lower prices, the lack of available parts in 2020-22 due to supply chain issues meant airlines and in some cases, OEMs, had to turn to PMA parts as they could not get access to the OEM equivalents.

COVID illustrated another significant advantage of PMA parts aside from price. In order to gain traction, HEICO has historically held a significant amount of inventory and sold parts to airlines and MRO shops on a just-in-time basis. OEMs have leverage so often don't do this and/or simply stop carrying parts for lower-volume parts using a patchwork of distributors instead. Delays in finding necessary parts can lead to expensive groundings. Below is a quote from Jet Parts engineering, a small PMAC competitor (c.$10m of revenue).

John Benscheidt, President, Jet Parts Engineering

“Right now, part availability is a major factor driving PMA purchasing and new part acceptance. Historically, part cost was the driving factor for PMA, but with the continued supply chain delays from the OEMs, turn times are being negatively affected at the MROs. It’s hard to pass up a PMA part that’s available now, allowing someone to complete an overhaul and bill the airline or get the plane flying again, when the alternative is to wait an additional 60 days for the OEM part to be in stock.”

While there is room for PMA penetration to go from <4% to 10%+ which is an attractive penetration opportunity in a secularly growing market, OEMs can theoretically threaten PMA competition by lowering parts prices. As a result, HEICO is deliberate in keeping penetration for the parts it sells to less than 30% share. While HEICO does enter into the odd price skirmish, an engine, landing gear, or avionics OEM will hurt pricing on the majority of their parts revenue and therefore ruin their economics, whereas HEICO's PMA portfolio is diversified (no part is a meaningful part of revenue) so HEICO is better positioned to defend against price competition, so this risk is overblown.

Development. HEICO currently has 20,000 PMA parts and develops 500 to 650 new parts each year. There is no revenue concentration. HEICO does have some centralized capabilities that study the market for new parts to develop as well as some centralized R&D capabilities for complex parts like engine fan blades which may require detailed engineering studies, but parts are otherwise developed at one of HEICO's 8 PMA subsidiaries. The upfront R&D on PMA parts is less cumbersome than an OEM part as HEICO is reverse engineering something that already exists, which is why HEICO can charge 30% to 50% less and still earn outstanding economics. Development still requires in-house R&D capabilities and an investment of c.2% of revenue or $37m annually.

There is no shortage of parts to develop as a 737 might have 600k which includes 50k to 100k MRO parts and each version of the 737 (there are c.10) requires a separate FAA approval. Lufthansa Technik might use 400k different parts. HEICO does not disclose the breakdown of their portfolio, but has suggested their portfolio is in-line with the broader MRO industry with limited concentration risk to specific plane models. HEICO's partnership with Lufthansa Technik in 1997 also means HEICO can get data on the most expensive/profitable parts that are regularly getting replaced to inform their R&D investments. Below are some examples provided by Heico of parts it develops.

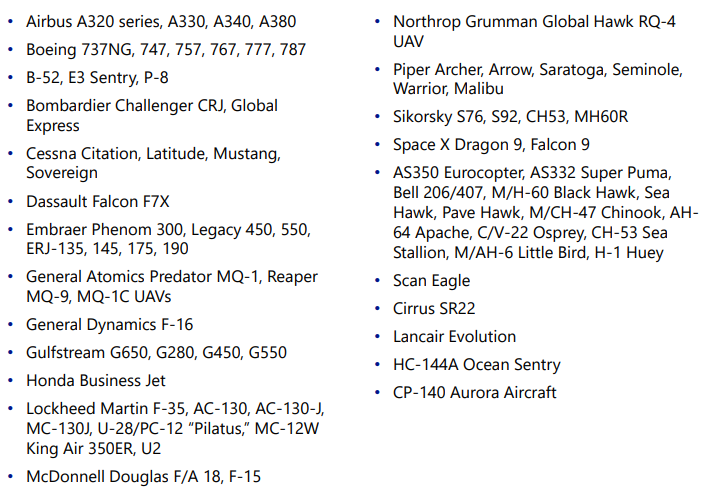

Below are some specific aircraft programs HEICO sells into. It is important to note that parts on each series of the A320 or 737 will require different FAA authorizations.

Manufacturing. HEICO's manufacturing is 50% in-house and 50% outsourced. HEICO is the only PMAC with enough scale to do meaningful manufacturing in-house, which gives them a greater ability to develop complex parts like engine parts and composite parts. Most competing PMACs are 90%+ reliant on external manufacturers (Wencor, the #2 player primarily outsourced). Howmet Aerospace and Precision Cast Parts (Berkshire Hathaway subsidiary) are examples of third party manufacturers, but the manufacturing landscape is fragmented. Manufacturing is mostly domestic so there should not be any meaningful impact from tariffs (2018 tariffs on China had minimal impact for example) and in fact, there could be some benefits to the extent OEMs face disruptions in their supply chains. HEICO avoids manufacturing in China due to IP concerns. Interestingly, PMACs sometimes use the same manufacturer as the OEM, further illustrating the point that the parts are exactly the same. Raw materials are a small part of overall costs as a small ziplock sized bag of washers or fasteners can be thousands or in some cases tens of thousands of dollars so tariff impact from input costs are de-minimis. Credit to Brasada Capital for posting this bag of HEICO spring seals that cost friggin $70,000, similar price to some BMWs!

While HEICO's scale gives it an R&D and manufacturing advantage, HEICO's real value-add is in approvals.

FAA Approval. PMA parts need to demonstrate equivalency to the OEM part for FAA approval. However, developing equivalent parts is not enough. It takes years for PMACs to establish the trust required to receive a regular cadence of FAA approvals. HEICO receives 350 to 500 approvals per year with an additional 150 from Wencor, collectively by far the most in the industry. Smaller competitors like Jet Parts Engineering may get 5 to 10 parts approved per year, and it is not something you can easily scale to 100 parts in a short period of time, so it will be difficult for a competitor to scale-up quickly meaning HEICO's 50%+ share is sustainable. In addition, HEICO has Organizational Design Authorization (ODA) allowing it to approve some parts in-house. HEICO's relationship with the FAA is underpinned by its 35-year safety record where it has delivered 85m parts with zero service bulletins, airworthiness directives or in-flight shutdowns. For context, an engine like the CFM56 will have thousands of service bulletins throughout its lifetimes.

HEICO's safety track record is exceptional but there are also structural reasons why PMA parts can have less safety issues. PMACs can observe parts in action for 5 years and avoid parts with inherent issues and in many cases, by the time a PMAC reverse engineers a part, there are more advanced manufacturing techniques available to improve upon the part.

Yusu Muhammad, President of ADPMa, a small PMA manufacture from InPractise

"We haven't seen any OEMs respond technically to us because most aircrafts you fly on were designed 30 to 50 years ago and the manufacturing technology is no longer the same. A realistic example would be a housing used in a landing gear actuator module. In the past, that housing had to come from a casting house and sometimes go through multiple processes and vendors, and there is a legacy cost to keeping that supply chain around. [We] gets parts machined from a billet plate with a 5 axis machining company, and those machines didn't exist back then. The OEM cannot overcome that differential unless they are willing to redesign."

Jason Dickstein, President of the Modification and Replacement Parts Association

“Today, there are a lot of PMA parts that are being designed to improve upon flaws that have been identified. Typically, the flaws are being identified by operators and they have had problems getting those flaws corrected. So, they’ve reached out to the PMA community and they’ve partnered with the PMA community to design a better part. So, while economics might’ve been the driving force 25 years ago, reliability has been a driving force for at least a decade."

In addition to these reasons, another reason is that HEICO has invested heavily into testing and inspection. HEICO knew early in its history that having minor safety issues would derail the FAA’s trust and subsequent approval of PMA parts and as a result, HEICO went well beyond industry practices to ensure safety. While most OEMs may rely on a material supplier's testing certificate and then test a sample batch of their manufactured parts, often via third parties, HEICO tests each individual batch of outgoing parts in-house. While this hurt margins, especially in the early part of HEICO's history, it allowed HEICO to develop the FAA relationship it has today, and importantly, avoid any service bulletins or safety issues.

Eric Mendelson, 2020 Forbes Article

“We do full a metallurgical inspection on every single lot of parts we produce. That includes material hardness, grain size, grain-flow structure, coatings. The reason we do it is because we can’t afford to have a failure.”

Eric Mendelson, Q4 2023 Call

"In order to get PMA, the part has got to be the same in terms of form, fit and function. Therefore, the way that we are able to differentiate ourselves with respect to quality is we typically have tighter tolerances, so we produce more consistent parts. And we also have an extremely robust quality inspection program. So, when parts come in from vendors, whether they are HEICO vendors or outside vendors, there's a very robust material analysis, whether the part is metal or not metal, to confirm grain size, microstructure, hardness, coatings, all of those various constituents to ensure that the part that we ship out is exactly what was designed. Likewise, we have a very robust inspection process to review the dimensions. So, I would say that with regard to basically shipping the part according to the design intent, HEICO score is incredibly high in that area. So, the parts are more consistent. Airlines are able to basically use them and install them right away. And the fallout or rejection rate with HEICO parts, we believe is significantly lower than with other companies' parts. So, they are improved in that regard."

Airline Approval and Pricing. The process of airlines approving a PMA part can also be complex. Airlines need engineers to evaluate the part, they need to invest in inventory systems to track PMA vs. OEM parts in their fleet, and airlines need to get comfortable with the supplier’s safety record. Airline maintenance departments are not always commercially orientated. HEICO implied that it once took a year to get a PMA cupholder approved. An airline might lease 50% of their planes and have different rules on PMA parts usage on leased versus owned. The quote below from a small PMA manufacturer illustrates the complexity.

Yusu Muhammad, President of ADPma, a PMA manufacture from InPractise

"The biggest challenge is the amount of work it takes to get it done. The OEM is the easy one because it's in the manual with the instructions. The cage code of the OEM is on the part they remove, so every piece of information makes it simple for them to go back to the OEM and get that part. Changing the coding within that system to procure from us involves a huge level of inertia, which is why you need to be mindful about which parts you choose to consider for PMA."

One important point is that once airlines approve a PMA part, it is unlikely another PMAC will emerge with a comparable part. There are hundreds of thousands of potential parts to develop so it does not make sense for a PMAC to intentionally compete against another PMAC. HEICO and Wencor are the two largest players but HEICO cited minimal overlap when they acquired Wencor. Moreover, airlines need to invest resources to get a PMA part approved so if an existing PMA part is already 30% cheaper, it doesn't make sense to dedicate more resources for an additional 5% or 10% savings. This means that once a PMA part is approved, the PMAC can in theory raise prices as long as they price below the umbrella of OEM pricing, which may increase 5% to 10%. However, it is short sighted as this dissuades an airline to make the upfront investments to engage that PMAC for subsequent parts.

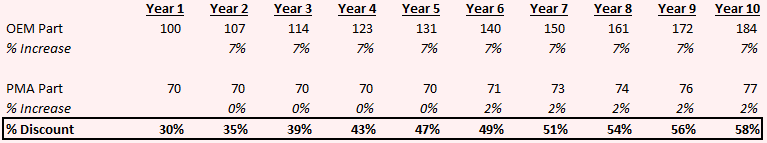

HEICO does not raise prices aggressively. HEICO has always had a long-sighted pricing and inventory strategy and takes pride in being customer centric. HEICO keeps prices flat for the duration of the contract (typically 5 years) and only raises price by inflation thereafter meaning part prices might start at 30% cheaper to the OEM equivalent but become 50%+ cheaper by the end of the contract given OEMs often raise prices HSD.

HEICO does get pricing benefit but from incremental customers, meaning as the OEM parts price increases by HSD, the new incremental customer will pay a 30% discount off that higher price. Price increases on existing customers are limited to cost inflation. Moreover, HEICO has always carried JIT inventory (FSG holds c.120 days) for all parts including parts for retiring plane models. HEICO's reputation for fair pricing and inventory, which was built over 35 years, means airlines can be confident that when they approve a HEICO part that they can count on the costs savings for the entire life of their planes, which might be 25 years. Reputation is difficult for new and existing entrants to replicate, especially those that are short-sighted on pricing.

Eric Mendelson, Q1 2025 Call

We clearly have left a lot of money on the table. Our philosophy always has been that we've got to cover our cost increases. And we exist because our customers need reasonable prices, coupled with the shortest turn times and the highest quality. And that's really what we've done. So the answer is no. We have not squeezed the orange in order to deliver these numbers. We could – frankly, I think our prices could be a lot higher, but we don't do that. And our prices have been, as you know, sort of the increases have been sort of low single digits, maybe the high end of low single digits, but really sufficient in order to cover our cost increases.

Having a long history with the FAA, a long history with airlines, and a 35 year history of treating customers fairly gives HEICO a significant advantage.

Customers. FSG's geographic mix is roughly 40/40/20 Americas/Europe/ROW. As a rule of thumb, HEICO tends to do well with large sophisticated airlines like Delta, America, United, British Airways, Lufthansa, etc. who have sophisticated in-house maintenance departments who can approve and manage PMA parts. HEICO also tends to do well with cost-focused airlines in Latam or India. Conversely, HEICO does less well with smaller less-sophisticated airlines who might outsource all maintenance. Low-cost carriers tend to view maintenance as non-core so outsource more maintenance. Finally, airlines with newer fleets in Asia and MEA tends to have lower PMA penetration.

Leasing companies account for 40% to 50% of the owned fleet and have historically been reluctant to approve PMA parts for several reasons. First, anticompetitive practices mean that use of PMA parts may disadvantage them when trying to get allocations for new aircrafts. Second, they may be worried that it will lower the residual value given some airlines are unwilling to buy planes with PMA parts. Interviews of various PMA industry insiders in trade magazines all imply that leasing companies approach to PMAs is changing, with COVID being a catalyst. For example, many leasing companies are going full-steam-ahead using PMA for interior components as they see the benefits to their returns given it lowers their maintenance reserves. Moreover, sophisticated airlines either 1) refuse to sign leasing contracts that do not allow PMA or 2) use PMA parts anyways but swap-them out for OEM parts when the lease expires. The sale of GE’s captive aircraft leasing unit (2019) also marks a shift as the leasing arm was pushing against PMA, something they are now less incentivized to do. If you consider that 40%+ of the fleet is leased, this development could meaningfully accelerate growth.

Sales & Distribution. HEICO is selling direct to airline maintenance departments and independent MROs rather than to distributors. While not disclosed, the majority (perhaps 75%) is direct to airlines. Sales to customers are typically done under 5-year contracts where pricing is either flat (0% to 1%) with provisions allowing HEICO to pass on costs. When HEICO develops a new PMA part, it typically has an anchor customer for that part under contract.

HEICO also has an in-house HEICO Distribution Group (4 different subsidiaries including Seal Dynamics). These distribution businesses are very similar to Diploma's fasteners and interconnect businesses. Seal Dynamics distributes HEICO PMA parts as well as the PMA parts of other PMACs and selective OEM parts via offices in New York, Florida, UK, Singapore, and Dubai. Various online sources suggest Seal Dynamics distributes 100k parts and is c.$25m revenue implying it is <5% of HEICO's PMA revenue. The acquisition of Wencor has likely doubled the size of HEICO's distribution businesses.

HEICO's distribution businesses help amplify the advantages of scale. When HEICO approaches an airline, it has a massive catalogue of PMA parts. What this means is that if an airline needs a component like an actuator repaired with 40 parts, HEICO can sell 10/40 as PMAs whereas a small PMA may only have 1 or 2 parts available, which is a hassle as the airline then needs to source the other 8 to 9 parts with other PMACs, hence HEICO has a scale advantage. Having some distribution means HEICO can bundle some of the 10 PMAs with additional OEM parts to make it even more convenient. It is not a huge part of HEICO's revenue (perhaps 10% of FSG revenue after the Wencor acquisition).

Wencor. HEICO acquired Wencor in August 2023 for $2.1bn, which made it the largest deal ever after the 2022 acquisition of Exxelia for €460m. At the time of deal, Wencor was expected to do $724m in revenue with $153m in EBITDA (21% EBITDA margins) in calendar 2023 implying HEICO paid c. 13.7x EBITDA, also the highest ever multiple. Founded in 1955, Wencor is the #2 PMAC behind HEICO (but about half the size). Wencor originally focused on distributing kits, seals, and bearings to military customers. In 1985, Wencor received its first PMA approval from the FAA. Over time, Wencor, like HEICO, grew its PMA portfolio as well as expand into component repair.

In 2010, Odyssey Investment Partners acquired Wencor. At the time, Wencor had 3,000 PMA parts, 300 staff, and approx. $150m in revenue. Wencor brought on a new CEO (Greg Beason) from Danaher/Honeywell who led Wencor until 2015. In 2014, Warburg Pincus acquired Wencor from Odyssey. Chris Curtis (formerly Schneider Electric) become CEO in 2016 until 2020. Chris retired in 2020 and was succeeded by Shawn Trogdon, Wencor's CFO who had risen up through Wencor starting off as Global Controller.

Today, Wencor has 953 employees and offers 6,000 PMA parts and produces c.150 new PMA parts annually. In addition, Wencor has distribution business which supplies MRO parts to the aerospace industry and consumables and materials to defence primes and the military, which is directly comparable to HEICO's Seal Dynamics business. Finally, Wencor has a maintenance and repair business (c. 30% of revenue) with the ability to do Designated Engineering Representative (DER) repairs.

Eric Mendelson said in an interview that Warburg Pincus had studied HEICO and tried to operate with a similar model meaning they pursued M&A (7 tuck-in deals under Warburg Pincus) but organized the subsidiaries into a decentralized operating structure, which has meant Wencor had a similar culture to HEICO.

HEICO has kept Wencor as its own autonomous subsidiary, but there should be some natural synergies as HEICO can sell a broader catalogue of parts to end-customers including PMAs and OEM parts via Wencor's distribution arm. Moreover, there may be opportunities for Wencor to leverage some HEICO manufacturing.

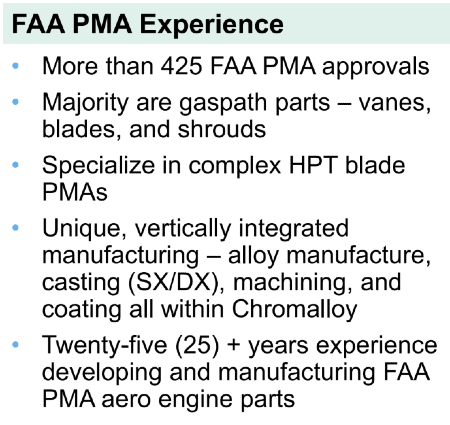

Competition. HEICO has, by various estimates, 50% share of the PMA industry. I should point out that the FAA can approve 30k parts annually (whereas HEICO develops 650) but that number includes a long tail of low-volume SKUs where OEMs may intentionally get others to manufacture the part so the "real" number of approvals is much lower. While there isn't hard data, after Chromalloy, there are no other PMA players of-note that claim more than a handful of PMA authorizations.

Chromalloy is owned by PE-firm Veritas and reportedly generates $750m of revenue across PMA Parts and Repairs which would make them in the same ballpark as Wencor. What Chromalloy has done is impressive. Chromalloy specializes in "hot section" parts in the airfoils, i.e. vanes and turbine blades, for major engine programs including CFM56. These are mission critical parts that undergo tremendous pressure and heat and therefore form a significant c.58% of the cost of repair on a major engine overhaul. Chromalloy has done this via in-house manufacturing expertise and partnerships with independent MROs that are trying to directly compete against (versus partner-with) engine OEMs.

Chromalloy has multi-year agreements with FTAI and AAR, two large independent repair companies. In the case of AAR, it is specifically for P&W's PW4000 engine. In the case of FTAI, it is specifically for the CFM56, the largest engine program today. While Chromalloy is a competitor to HEICO, they are not a direct competitor as they are focused exclusively on turbine blades (they are targeting a handful of PMA approvals, i.e. 5 with FTAI for CFM56, albeit of highly valuable parts). The table below from a Chromalloy presentation summarizes their focus which is much more targeted.

Chromalloy based on what is publicly available, looks to be a formidable player but with limited overlap with HEICO and a strategy focused on depth of expertise on specific high volume engine parts versus the breadth of expertise that HEICO has.

RBC Capital Markets analyst Ken Herbert

“Chromalloy is the only company not affiliated with a large OEM with the capability and expertise to make hot-section aircraft engine PMA parts, one of the most expensive parts in aircraft engines”

After Chromalloy, there is a long tail of mom-and-pops. Jet Parts Engineering also looks to be an up and coming player, but online sources suggest <$25m revenue with only a handful of authorizations. Smaller PMACs do not represent a big threat to HEICO. You cannot go from a pace of getting 5 FAA approvals to getting 50 approvals overnight, but rather, PMACs can slowly scale up the number of approvals they get, and given HEICO is at a scale, especially with Wencor, where it can get 650 approvals annually, HEICO's lead is widening. Moreover, to the extent smaller PMACs have success, they will develop parts that don't get in the way of an existing HEICO part.

The bigger threat comes from OEMs themselves. As previously mentioned, OEMs have historically threatened to void warranties but recent rulings by IATA (the airline industry body) against OEMs should help mitigate this practise which many view as illegal. In any case, HEICO tends to offer more generous warranty coverage on their parts (i.e. warranty the part and all negative effects) versus OEMs (which may only warranty the part itself). OEMs have also increased power-by-the-hour contracts but it should be noted these contracts are concentrated to engine OEMs. Most larger airlines sign-up for PBH for the first 5 years to hedge against teething issues on an engine, of which there are many (P&W's GTF and CFM LEAP), after-which they switch to doing MRO in-house or using third parties.

Even factoring in service agreements 1) there is plenty of room for HEICO to grow in areas where there are no service agreements 2) they can avoid OEMs that have stronger power-by-the-hour contracts such as Rolls Royce and 3) power-by-the-hour contracts have high adoption in the early years but airlines shift into doing their own maintenance in later years to drive savings. The sweet spot for PMA parts has always been planes in the 10+ year range where planes may be entering their first major overhaul.

Competitive Advantage. Conceptually, HEICO is selling an equivalent (or better) product at a 30% to 50% cheaper price, which gets even cheaper on a relative basis over time, and HEICO is doing this whilst carrying reliable amounts of inventory, even for low-volume parts. The value proposition is compelling which is why I expect PMA penetration to inevitably creep forward. I don’t want to diminish the importance of having scale, technical expertise, in-house manufacturing, testing and inspection capabilities, a strategic relationship with Lufthansa Technik, a global sales and distribution footprint, and adjacent distribution capabilities, but the major source of moat comes down to trust. In order to be successful in the PMA industry, you need the trust of both the FAA and Airlines. HEICO has earned that trust over 35 years. Moreover, HEICO has earned the trust of Airlines (19 of top 20) by having fair pricing and adequate inventory, even for slower volume parts. HEICO's stable family ownership is a key factor in this very long-sighted strategy as it is relatively easy for HEICO to maximize near-term or even medium-term earnings by raising prices under the umbrella of OEM price increases. HEICO is playing the long-game given the enormous runway to increase PMA penetration. This advantage has manifested itself in HEICO having 50% share of the PMA industry. This share is sustainable as a new PMAC cannot scale overnight and most don't have the same long-term mindset to HEICO.

Repair & Overhaul (22% of FSG Revenue)

In order to repair an OEM part, the repair facility needs an authorization from the OEM. An engine OEM like GE cannot do all of the repairs in-house so will develop preferred relationships and provide repair manuals to repair shops like Standard Aero and these agreements often specify that the repair shop will only use OEM parts. In aggregate, the workhorse CFM56 will be maintained 40% by GE/Safran and 60% by airline maintenance departments and independent MROs.

HEICO focuses on DER repairs. Designated Engineering Representative or DER is an authorization by the FAA to do repairs outside of the OEM's manual. DER is like a PMA-repair. HEICO tries to figure out a repair without having access to the OEM manual, and get FAA approval for that repair. DER repairs are often done on newer plane models <10 years old where an ecosystem of aftermarket parts and repairs has not yet been developed or conversely on very old plane models where it is difficult or expensive finding spare components.

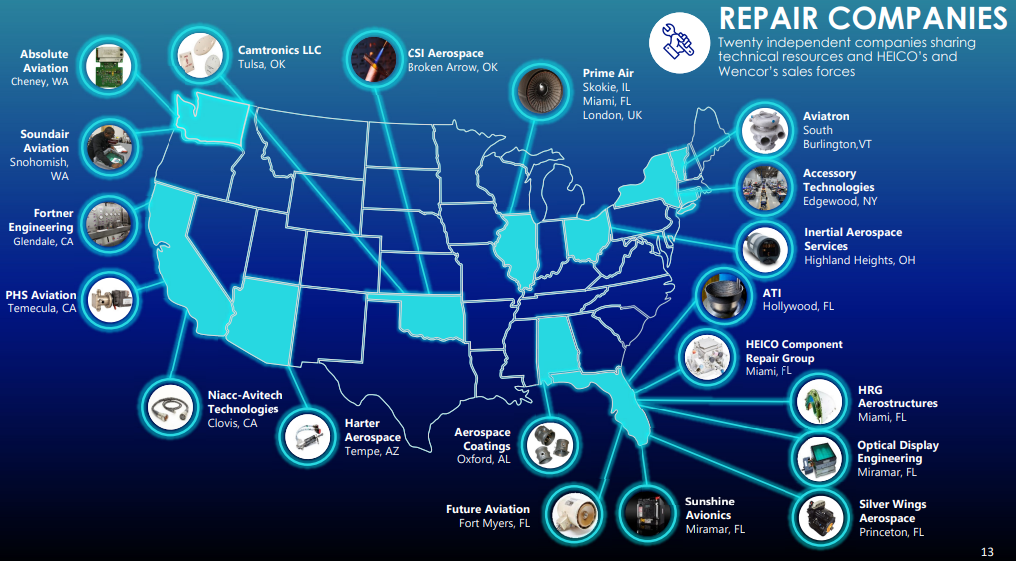

HEICO provides these repairs on 32k aircraft components. These repairs are done by 20 independent companies across the US. Components overhauled include fuel pumps, generators, fuel controls, pneumatic valves, turbo compressors constant speed drives, hydraulic pumps, valves and actuators, wheels, brakes, composite flight controls, electro-mechanical equipment, auxiliary power unit accessories and thrust reverse actuation systems.

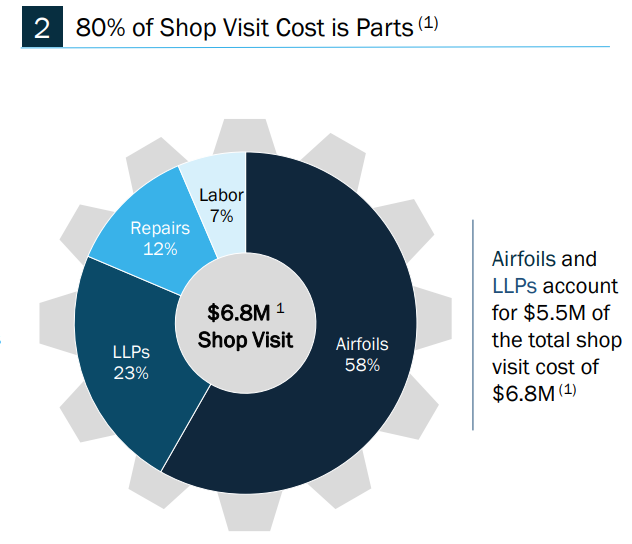

HEICO's focus on sub-systems whereas large independent MROs tend to focus on engines. In some cases, an independent MRO may even outsource the repair of a specific component to HEICO. Unlike a car repair where labor is the primary cost, in aerospace, the majority of repair costs relates to the parts (80% in the case of engines per FTAI) so the Repair & Overhaul business is a way for HEICO to sell more PMA parts as well as generate revenue for HEICO's distribution businesses.

Having access to a broad catalogue of PMA parts gives the Repair & Overhaul business a significant cost advantage. In order to drive higher PMA penetration, HEICO can quote a repair job with and without PMA parts (the repair with PMA will be substantially cheaper) with the customer often choosing the PMA option after seeing the price differential.

Specialty Products (15% of FSG Revenue)

HEICO is a Tier 2 supplier to aerospace OEMs. The Specialty Products business manufactures thermal insulation products, complex composite assemblies, and other niche components primarily for aerospace and defence. HEICO also has some manufacturing capabilities within the specialty products area including the ability to manufacture advanced niche components and complex composite assemblies. HEICO's CFO said margins are broadly in-line with the PMA business, suggesting the components are high value-add. HEICO was rumoured to be interested in Esterline which would have been a significant expansion of the Specialty Products business (was acquired by TransDigm for $4bn in 2018).

Growth of FSG

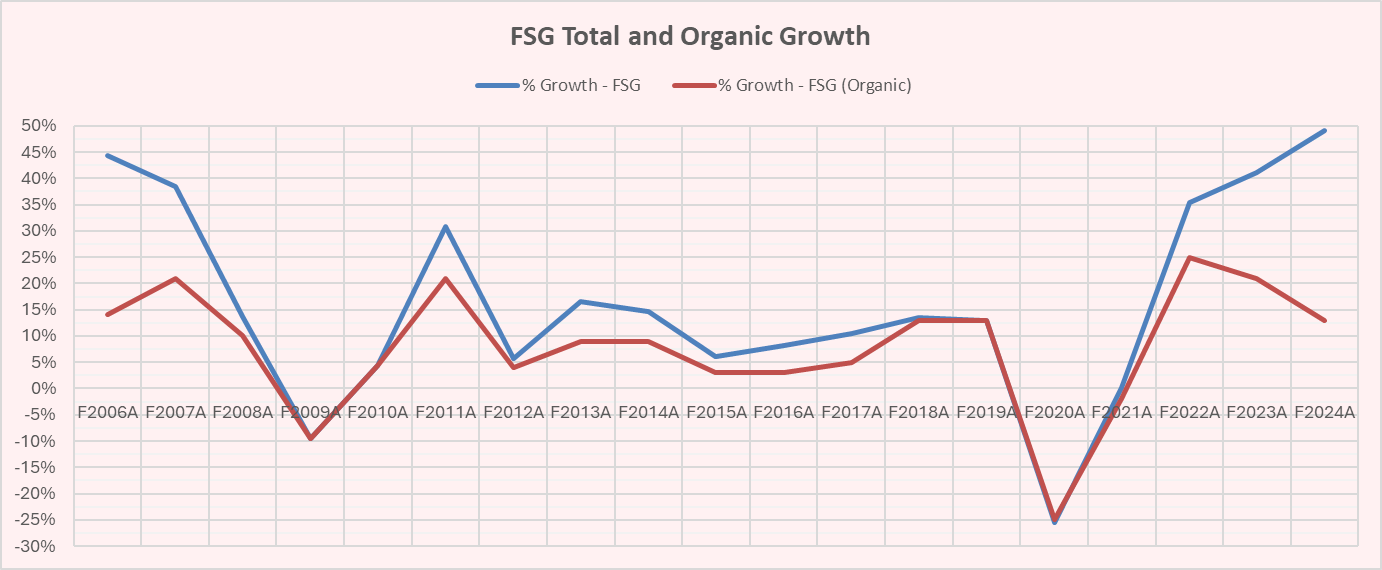

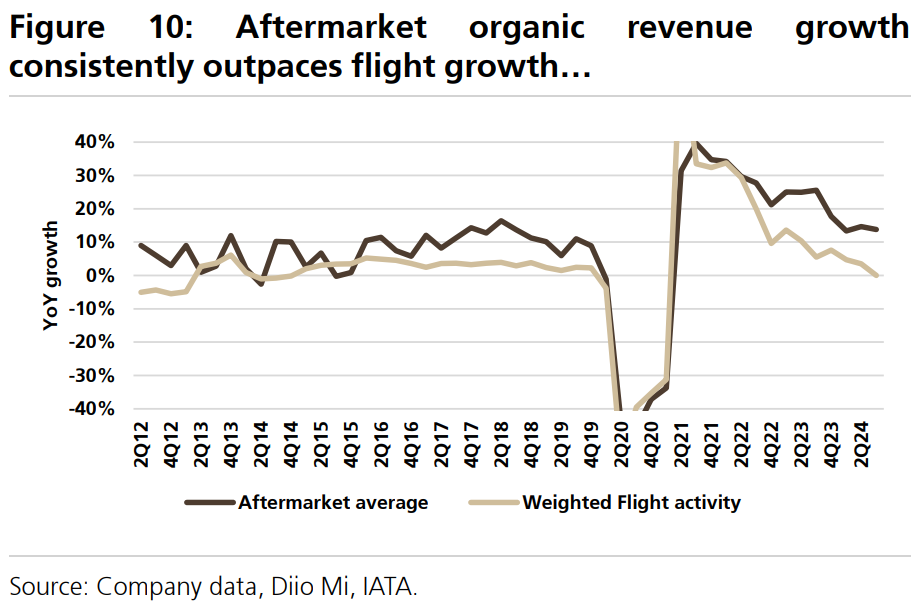

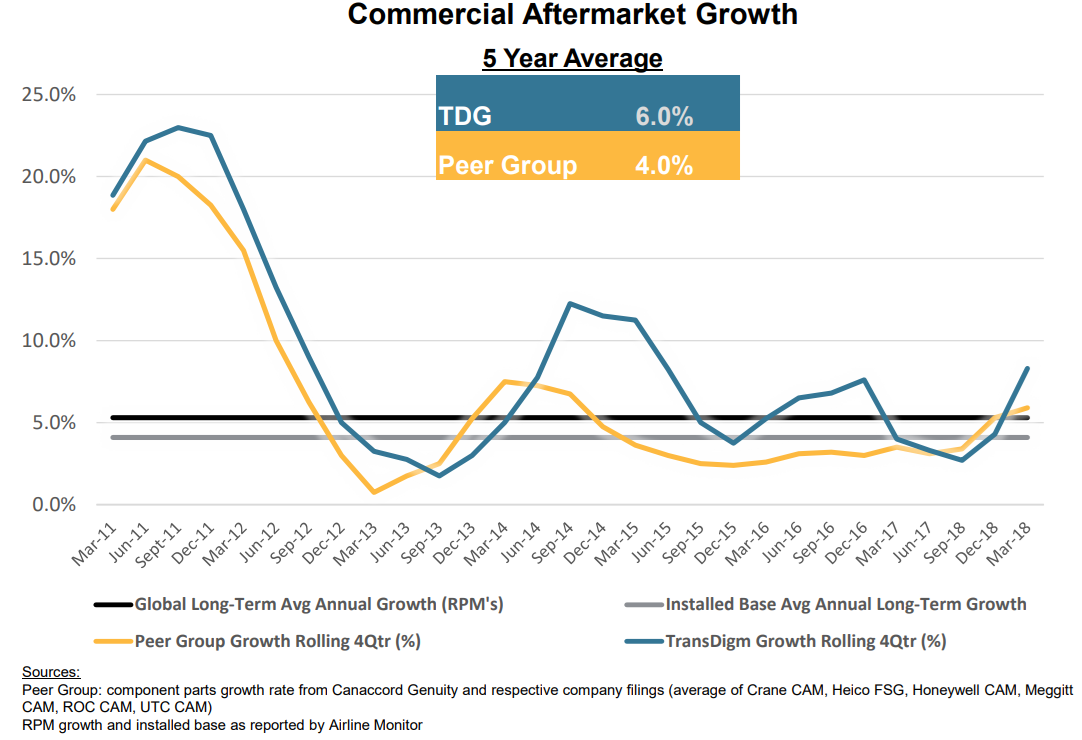

HEICO has historically said they target HSD organic growth in FSG. Over the last 10 years, total FSG growth has been 13% cagr while organic FSG growth has been 6% cagr. HEICO is growing about 1% faster than the MRO industry driven by higher PMA penetration. This is primarily being driven by volume, not price, with optionality longer-term for HEICO to accelerate pricing when PMA penetration matures. Near-term, there are some nice tailwinds which should accelerate organic growth into the 7% to 11% range. I break this down step-by-step.

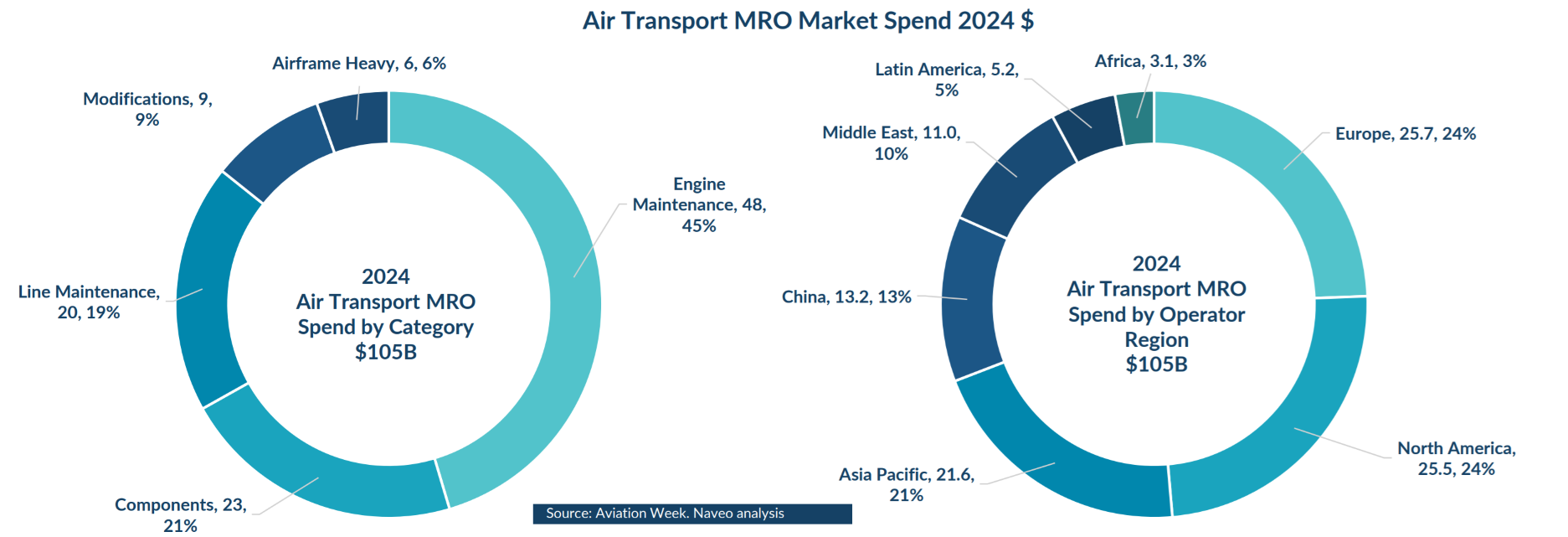

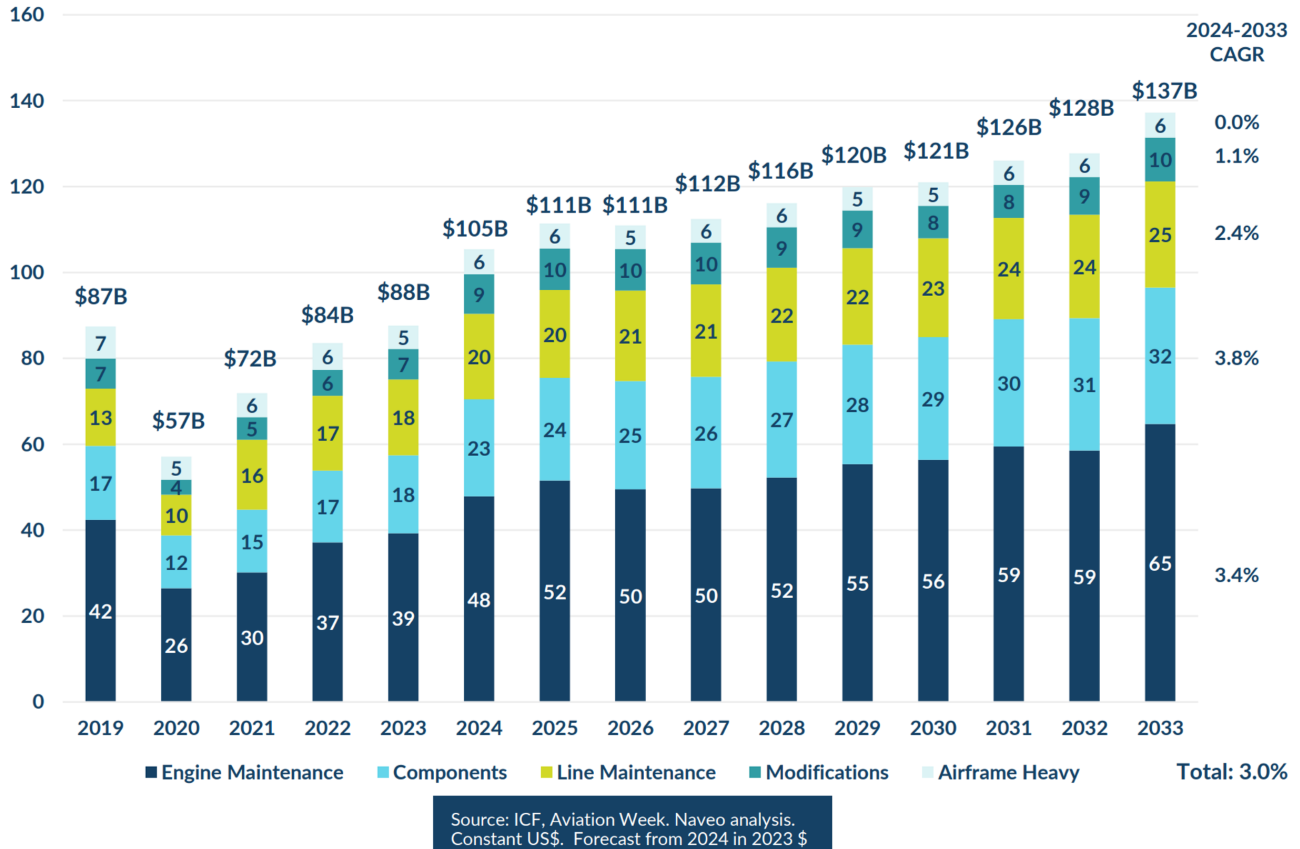

Total Addressable Market. The MRO TAM is $105bn broken roughly a quarter each into Americas, Europe, APAC, and ROW. There is no definitive TAM estimate for PMA it is likely between 1% to 4%. The PMA TAM is also global. PMA use is widely accepted in major countries including Germany, Japan, and China. The table below gives you a sense of the TAM by components: engines being by far the largest component at 45% of the MRO TAM.

Growth in TAM. Historically, MRO has grown 4% to 5%, typically above RPK growth as volumes increase with mileage (and even faster if the fleet ages) and MRO companies have pricing power on top.

Air Traffic + MRO Outgrowth. Air traffic grows at GDP+1% over the long-term driven by an emerging middle class. ICF estimates call for 3% MRO cagr, but off of a 2019 base. We only started hitting air traffic 5% to 15% above 2019 levels in 2023 so if you take these estimates using 2023 as a base year, the projected MRO industry growth from 2023-33 is c.5% cagr which sounds right to me and is consistent with historical growth. However, HEICO is not constrained by MRO industry growth in the near-term given HEICO is small enough that they can try to pick and choose more attractive sub-segments that are growing faster.

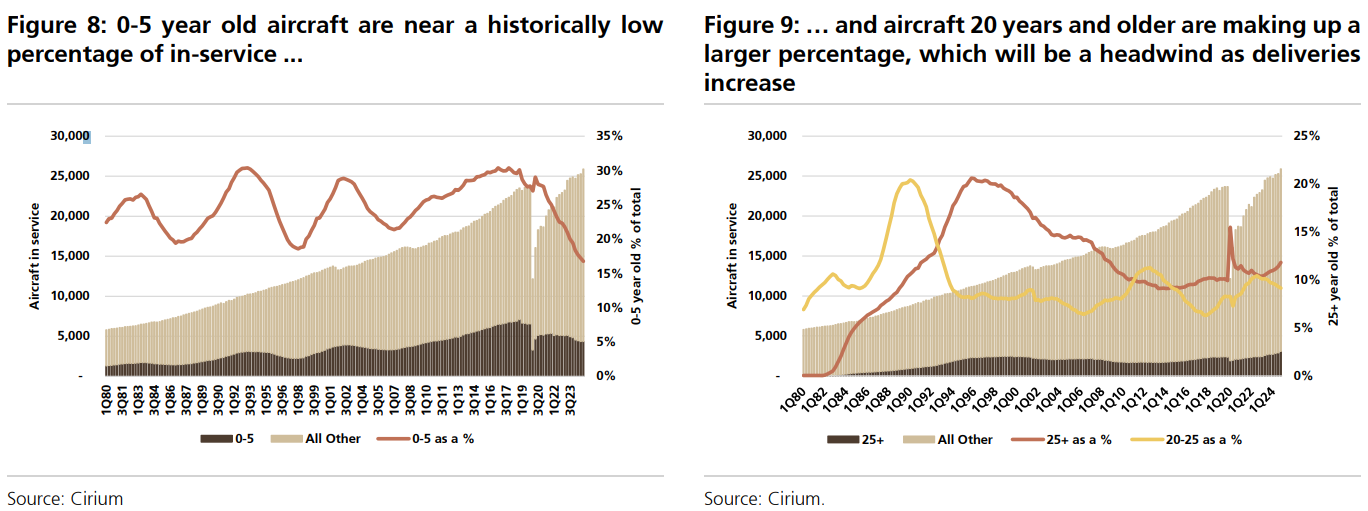

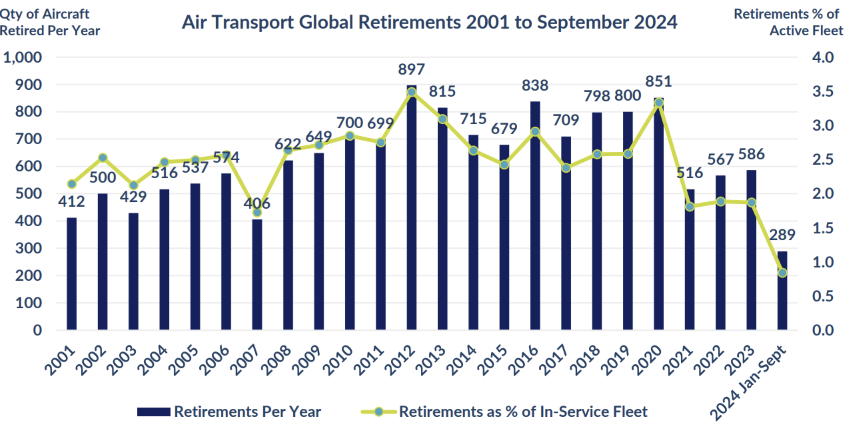

Aging Fleet. Under the backdrop of 5% long-term growth, there are fluctuations in any 3 to 5 year period and this has mostly been driven by the average age of the fleet. As new planes ramp up like they did in the early-90s, early-2000's and more recently during the 2016-17 period, MRO growth tends to slow down as the sweet spot of 10+ year old planes shrinks. That is because the major overhaul events on a plane tend to come in latter years like years 10, 15, 20, and 25 with a large period from years 0-10 where there is fewer maintenance requirements and to the extent there are, they are done by OEMs. With elevated retirements, not only does the sweet spot for PMAs shrink, but this can be exacerbated by MRO departments using used serviceable material (USM) parts, basically recycled parts from retiring planes. Conversely, as the fleet begins to age, MRO growth accelerates as more planes hit the sweet spot.

This table from TransDigm's 2018 Analyst Day shows you the dynamic of slowing MRO growth from 2014 to 2018 when the fleet was getting younger and where we saw HEICO's FSG organic growth decelerate to 3% to 4% from 2015-17.

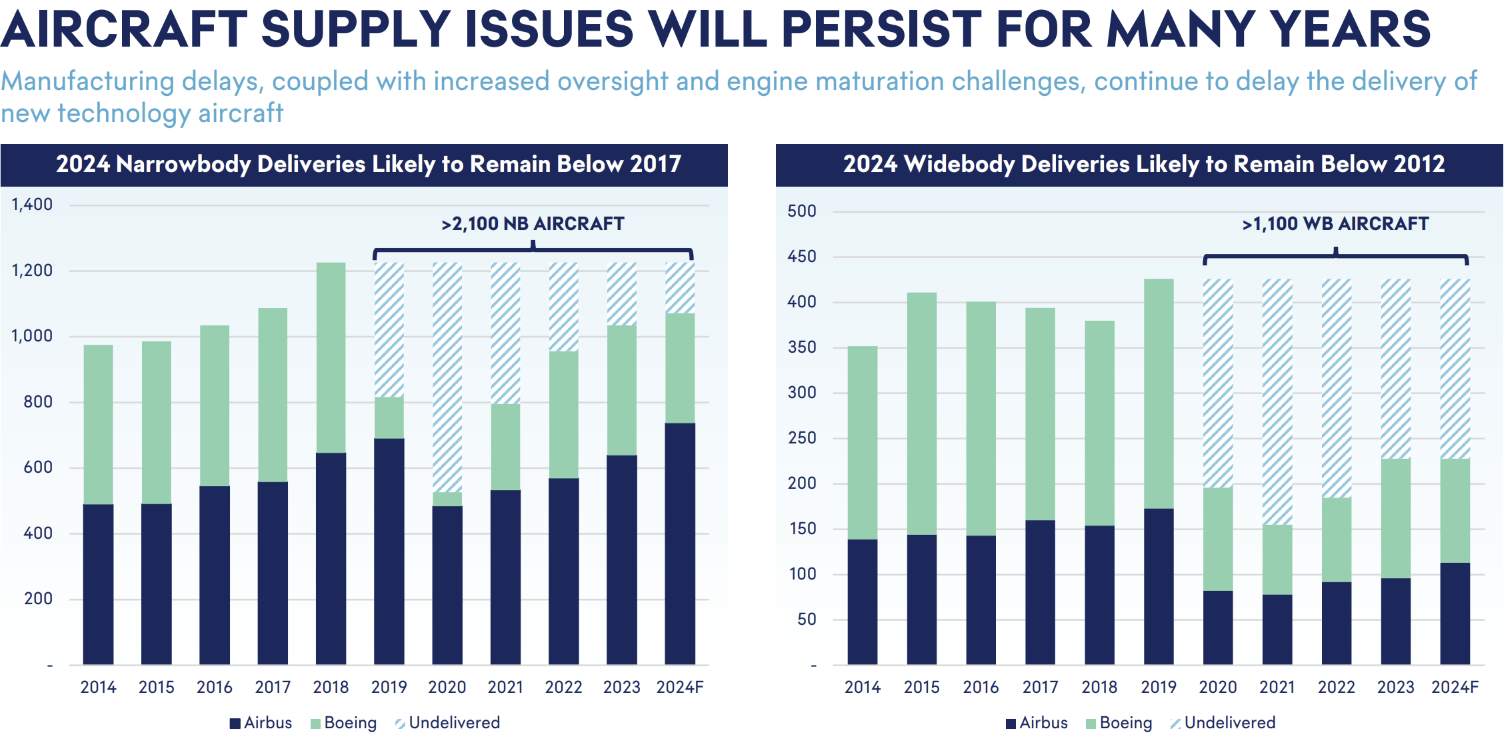

During COVID, most analysts forecasted elevated retirements. However, the 737 MAX groundings and teething issues from P&W's GTF engine meant older aircrafts were never retired. In fact, the percentage of planes in the 0 to 5 years old range is near an all-time low and the mix of aircrafts 25%+ is trending higher.

This table gives you a sense of the interruptions to new deliveries.

This table in return shows you the relatively low rates of aircraft retirement.

Because of these dynamics, we will likely be in a sweet-spot until Boeing can catch-up on deliveries which most analysts expect will take at least 5 years, if not longer. As a result, we are entering an extended sweet spot period. Despite organic growth being 25%/21%/13% in 2022/23/24, the 5-year organic cagr from 2019-24 is only 5% due to the huge drop we saw during COVID. As air traffic continues to normalize, we can see growth naturally accelerate into the 6% to 7% range. When you add the aging fleet on-top, you could see organic growth being more like 7% to 11%, albeit any negative macro headwinds from the trade war will be a headwind.

PMA will Increase Penetration of MRO. PMA's are still a tiny part of MRO spending with significant runway for growth. It is reported that penetration within high volume users like Delta and Lufthansa can be 8% to 12% meaning the addressable TAM could increase 3x to 4x over-time if everyone else uses as much PMA as Delta. Events that force airlines to look for cost savings, i.e. recessions, oil prices, 9/11, COVID, inflation, supply chain issues, tariff wars etc. all tend to accelerate PMA adoption, which should act as an additional near-term tailwind.

Leasing Market is Cracking. Leasing is 40% to 50% of the market and historically accepted very little PMA parts but as this changes, the TAM can double again. In my view, there is a flywheel effect where broader PMA adoption by airlines lowers the residual value risk of leasing companies, who in turn allow for PMA adoption, which in turn drives greater PMA adoption by airlines, creating a flywheel.

AAR CEO - Q3 F2025 Call

I mean lessors in particular, we do see increasing openness to adopt PMA. I mean obviously, what FTAI's been able to achieve is a big part of that kind of change in mindset out there. So we do see that as a market. But more than that, we see many end users that own the engines, and they'll lease them, as open to these particular PMAs. And the BELAC PMA is on the CF6 ADC2 and the Pratt & Whitney 4000 engines, these PMAs have been in existence for many years. They're well-established technology.

IATA/CFM Agreement. This is another idiosyncratic factor that should drive growth. In July 2018, IATA, which represents 290 airlines and CFM (50/50 JV between GE & Safran), signed an agreement that established a set of policies to promote fair competition in CFM’s aftermarket for engine parts & services. For context, CFM engines are 2/3rds of the global narrow body fleet. In the past, CFM used tactics such as threatening to void warranties, refusing to license engine repair manuals to third-party repair shops or refusing to sell CFM spare parts to distributors that also carried PMA parts. The new agreement puts an end to these anti-competitive practices. The agreement came two years after IATA filed a complaint with the European Commission that accused CFM of abusing its dominant market position. HEICO will directly benefit from the agreement since PMA parts were unable to penetrate certain portions of the CFM engine spare parts market. The agreement also discourages other OEMs from trying to abuse their power given the success IATA has had against CFM. The agreement took effect in Q2 F2019, right before COVID, so we have not seen the positive impact on the PMA industry yet. This boost is difficult to model as it will take several years for HEICO to develop a portfolio of CFM parts and introduce them to customers, but HEICO has implied that this development is significant.

Q1 2019 Earnings Call – Larry Mendelson,

“The resolution is very clear in what's expected in both parties. And I can tell you that we've had a lot of very positive discussion with a number of our customers, our customers have certainly taken note of this and I think are hopeful and I'm hopeful that it will end up to really everybody's benefit. When you look at the PMA potential out there for the engines, this is not going to significantly impact the OEMs. The OEMs will continue to have a majority of the business and I think are going to do extremely well. We refer to it more as sort of nibbling around the edges, and their customers want competition and I think that we're providing it in a way that's meaningful for us, but not that significant for the OEMs and really won't hurt their business model. So to answer your question, I think it first starts with discussions and then we need to see where it goes from there. But the airlines are very aware of it and they are very intent upon using it to their benefit, I know that we are also having discussions with airlines about how they view these changes in the marketplace and how that could open up certain other markets.”

7% to 11% near-term growth and 6% long-term growth. When you put it all together, the MRO industry should grow around 5% longer-term. There are tailwinds in the next 3 years due to the aging fleet. The PMA industry should in-turn grow even faster aided by a focus post-COVID on profitability and generally broader acceptance of PMA parts driven by factors like IATA/CFM and more acceptance amongst leasing companies, which would then imply growth in the higher-end of 7% to 11% near-term and 6%+ longer-term. Within this context, while I believe HEICO will likely be a share gainer in terms of volume, HEICO's reluctance to raise price means that in value-terms, HEICO's share gains are likely modest. This does create an interesting situation where HEICO is building up significant latent pricing power, but this will likely only be a consideration when the PMA industry is truly mature, which is likely at least 20+ years away.

Electronic Technology Group (32% of Revenue, 34% of EBITA)

The ETG business is harder to analyse because rather than having a single business (the PMA business) be the bulk of revenue, ETG is a collection of dozens of small subsidiaries that all do similar, but different things. HEICO started expanding beyond commercial aerospace into ETG in the late-90s/early-00's due to some natural adjacencies as well as a desire to diversify.

The remaining write-up will include:

- Deep Dive of HEICO's Electronic Technology Group

- Growth of ETG

- HEICO's Management

- Capital Allocation Philosophy and Organizational Model

- Capital Allocation Track Record

- Summary of Investment Thesis

- Economics and Key Drivers

- Valuation

- Historical and Projected Financials