Deep Dive: Reply SpA (REY, REY.MI)

Italian IT-services serial acquirer with unique organizational model and culture

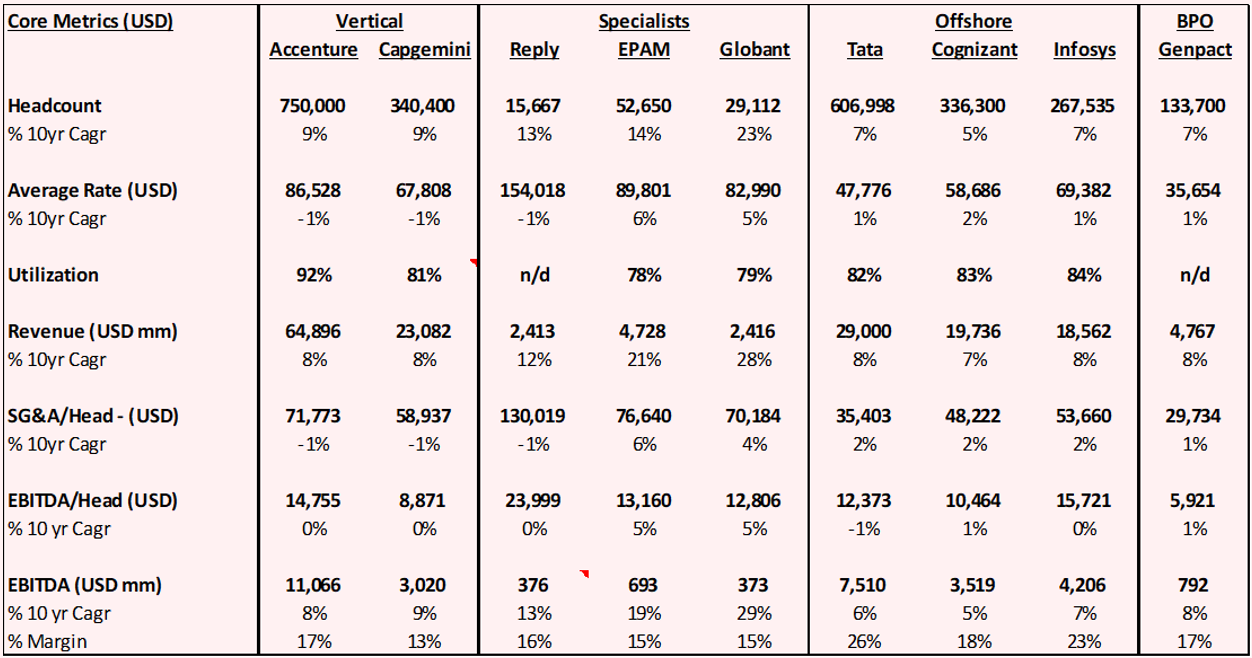

Please read my Deep Dive: IT Services Primer before reading the Reply initiation. As you may recall from the primer, Reply stood out as having $24k in EBITDA/head, approximately double vertically integrated peers Accenture, near-shore players like EPAM and Globant and offshore Indian players like Tata and Cognizant. Reply’s EBITDA/head performance isn’t unique. Many onshore consultants specialized in high-end digital technologies generate comparable or better performance. Kainos, a UK onshore consultant focused on Workday generates $30k/head. Wavestone, a French onshore consultant focused on digital transformation generates $22k. Finally, Hackett Group, a US onshore consultant focused on consulting related to AI is even higher at $36/head.

However, Reply does have one very unique attribute. While everyone’s strategy is focused on growing headcount, revenue/head, revenue/client or reducing SG&A/head, Reply operates along a very different vector. Reply is growing the total number of boutiques. All of the aforementioned peers are effectively 1-boutique businesses whereas Reply has gone from 6 boutiques in 1996 to 230 boutiques today (14% cagr). In other words, the vector of compounding is different and while this isn’t the fastest way to grow, it is the most durable, anti-fragile, and sustainable way to grow, which is why Reply is unique.

Founded in 1996, Reply is an Italian IT-services company based in Turin with 15k staff focused on consulting. systems integration and digital communications. Revenue breakdown is Italy (55%), Germany (20%), UK (15%) and US (10%). Reply has a unique operating model where it organizes itself as a decentralized collection of 230 autonomous boutiques (€10m average revenue) each focused on a niche. Reply’s model allows it to benefit from the advantages of an agile technology-forward boutique whilst also benefiting from the diversification of a larger company. Reply's model has proven scalable and well-suited to a serial acquisition strategy with Reply having redeployed 50% of FCF back into M&A over the last decade. Reply has done c.50 acquisition since inception.

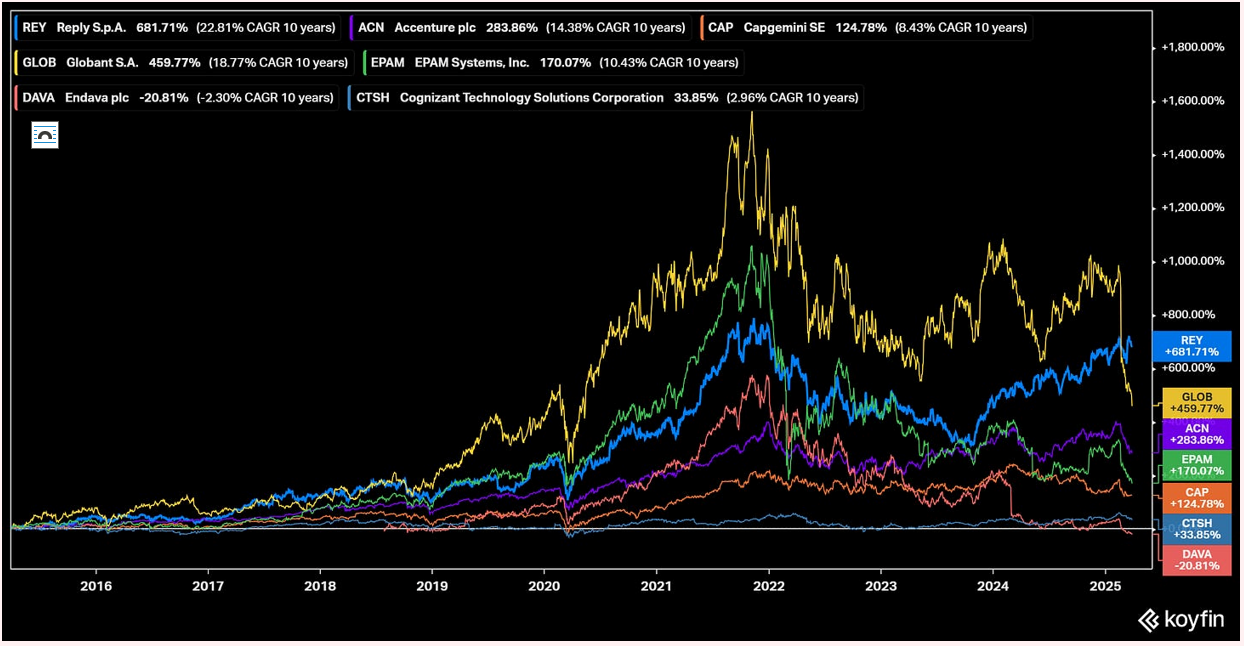

Over the last 15 years, Reply has grown revenue 14% (4% M&A, 10% organic), EBIT 16% and EPS 18% cagr and shares have compounded 28.6% dividends reinvested. Reply has achieved this growth without being reliant on a low-cost workforce or riding a specific vendor or technology wave, proving the inherent value Reply creates. Rather, Reply has been highly diversified by end-market, vendor, technology, customer, etc. Given Reply plays in a massive $1.3tn TAM, Reply has a long runway to continue replicating this success for the foreseeable future. Over the last 10 years, Reply’s shares have compounded 22.8% cagr outperforming peers including Globant (18.8%), Accenture (14.4%) and EPAM (10.4%). In this report, I'll explain why.

Before going over the investment thesis, I’ll explain Reply’s unique organizational model, incentive system, and culture.

Background & Organizational Model

Reply was founded by Mario Rizzante (currently aged 76) in 1996 with 5 co-founders and listed in 2000 when revenue was €30m. Mario is still the Chairman and holds 37% economic and 54% voting interest. His children Tatiana (Co-Founder, Co-CEO since 2015, 54 years old) and Filippo (CTO, aged 52) are involved in the business and sit on Reply's board. Mario describes Reply as a series of specialised boutiques working under a shared roof. While Reply’s operating model is original, it is surprising how much similarity there is between Reply and Constellation Software and some successful serial acquirers focused on industrial niches. I will describe the model, then in the boxes describe how this leads to a competitive advantage.

Specialised Small Boutiques

Everyone consultant wants to play in the fastest and highest value-added areas of IT like AI, IOT, metaverse, quantum computing, humanoid robots, etc. For consultants, these sectors have the highest growth and the most attractive economics. The problem is that in the early days of the technology, the TAM is too small or the technology too nascent for most mid- or large consultants to go after. An elephant like Accenture would need to make upfront bets on the future of this technology (say GenAI) which might include retraining 100k employees and developing large centres of excellence, exposing Accenture to technology risk.

Reply is different. They are a collection of 230 small boutiques, all focused on a single technology, ideally in a single geography or single industry. Reply believes the high degree of specialization, agility and local delivery from this boutique model is the best way to capture value in high-growth innovative areas of IT. Reply is willing to take significant steps to guarantee this specialisation advantage. Reply started off with 6 boutiques in 1996 but today expanded mostly organically to 230 boutiques, each with a unique specialisation.

Boutiques originate as specialists in a specific technology within a local region. As boutiques expand, Reply will split boutiques into two to retain the high degree of specialisation. Examples meriting a split may be a banking specialist expanding into insurance, an AWS specialist expanding into Azure, or a Northern Italian boutique expanding to Southern Italy. This is counterintuitive as most boutiques such as Kainos are early to the surge in a vendor (in Kainos’ case, Workday) and double down on the wave. Kainos scaled to £380m in revenue but now has huge concentration to a single vendor, exposing it to technology risk and an eventual erosion of the value proposition. As a rule of thumb, Reply caps boutique revenue around €30m, the point where bureaucracy takes over, which takes an unconventional mindset.

While Reply’s largest boutiques tend to have specialisations in mainstream vendors like Microsoft or SAP, Reply has a long tail of niche boutiques that do everything from video-creation using AI to building robots to identify maintenance issues on bridges and tunnels. Some examples of boutiques:

- Cluster Reply (Microsoft Azure)

- Storm Reply (Amazon AWS)

- Arlanis Reply (Salesforce)

- Click Reply (Supply chain)

- Discovery Reply (Digital experience)

- Gaia Reply (Mobile applications)

- Sprint Reply (Process automation)

- Target Reply (Data Analytics)

- Autonomous Reply (Autonomous devices)

- Roboverse Reply (Robotics)

Reply is trying to develop and sustain a specialisation advantage. By forcing boutiques to split, Reply ensures that every boutique remains agile, close to their end-customer, and highly specialised. Many boutiques face the trap of specialising in one-area (say CRM) but chasing growth in another diluting their original expertise. Similarly, many boutiques start off being close to their key customers but expanding too fast, eroding the core relationships that made them successful. Reply does the opposite. While this strategy has trade-offs in the form of duplicate overheads, hurt egos, and potentially lower revenue growth, Reply believes the trade-offs are worth-it long-term.

Spin-offs are a talent retention tool. The constant splitting up of boutiques creates the need for a new CEO, CTO, etc. which acts as an off-ramp for talented managers who may otherwise have not gotten these opportunities in their prior boutique. This acts as a critical talent retention tool. In the geographies where Reply is mature (Germany and Italy), attrition is just 12% to 16% and Executive Partners have an average 18-year tenure.

Reply’s model makes growth scalable. Reply is at a scale where it has a highly diverse group of boutiques so is not overly reliant on any single technology, geography, vendor, or customer. This means Reply can keep splitting divisions and executing on the playbook, which may hurt growth for a small group of boutiques but in aggregate, the diversification allows Reply to generate consistent organic growth.

This model is harder to replicate than it looks. Companies that are designed to maximize revenue/client may have bundled a lower value proposition BPO service with a consulting project to win that client, so splitting up divisions may be infeasible. This is similar to the approach Constellation Software has, which Mark Leonard spelled out in his 2016 letter (lightly edited for brevity).

“While we have developed some techniques and best practices for fostering organic growth, I think our most powerful tool is using human-scale BU’s. When a VMS business is small, its manager usually has five or six functional managers to work with: Marketing & Sales, R&D, Professional Services, Maintenance & Support and G&A. Each of those functional managers starts off heading a single working group. If the business leader is smart, energetic and has integrity, these tend to be halcyon days. All the employees know each other, and if a team member isn't trusted and pulling his weight, he tends to get weeded-out. If employees are talented, they can be quirky, as long as they are working for the greater good of the business. Priorities are clear, systems haven't had time to metastasise, rules are few, trust and communication are high, and the focus tends to be on how to increase the size of the pie, not how it gets divided.

That structure usually suffices until there are perhaps 30 to 40 people in the business. At that stage, some of the teams - perhaps R&D if the product is rapidly evolving or has high needs for interfaces or compliance changes - must grow beyond the five to nine optimal team size. If the head of R&D in this example is brilliant and is willing to work hours that are unsustainable for most of us, he may be able to parse out tasks for each of the team members despite the increased team size. He may be able to judge the capabilities and cater to the development needs of each of his direct reports. He may be able to recruit excellent new employees, and he may be able to manage the demands and trade-offs required to coordinate with the other functional managers. The more likely outcome, is that the R&D manager isn't a brilliant workaholic and cannot cope as the team size exceeds double digits. Instead, he'll break his team up into multiple teams. A new level of middle managers will be born, with all the potential for overhead creation, politics, and bureaucracy that comes with another tier of middle managers.

The larger a business gets, the more difficult it becomes to manage and the more policies, procedures, systems, rules and regulations are generated to handle the growing complexity. Talented people get frustrated, innovation suffers, and the focus shifts from customers and markets to internal communication, cost control, and rule enforcement. The quirky but talented rarely survive in this environment. The challenge of running a BU of this size is human-scaled. As a BU becomes larger (by our standards, that’s greater than 100 employees), I worry that even an extraordinarily brilliant and energetic manager is going to struggle to steer the business to above industry average organic growth.

This is the point at which our Operating Group Managers or Portfolio Managers can provide coaching. If a large BU is not generating the organic growth that we think it should, the BU manager needs to be asked why employees and customers wouldn't be better served by splitting the BU into smaller units. Our favourite outcome in this sort of situation is that the original BU Manager runs a large piece of the original BU and spins off a new BU run by one of his/her proteges. Ideally, he/she has been grooming a promising functional manager who’ll be enthusiastic about running and growing a tightly focused, customer-centric BU.”

Mark Leonard, 2016 Letter (Lightly Edited)

Decentralization and Networks

To leverage the advantages of specialisation, Reply believes in decentralization. Each boutique is its own autonomous business, managed by a Partner. Reply does not need a 39-person committee coordinating areas of focus and making directives. Only back-office functions such as HR and Finance are centralized. Otherwise, Partners oversee R&D, sales, marketing, strategy, execution, etc. and are fully responsible for their own PNL. Reply does not micromanage boutiques.

Boutiques are grouped into networks of 5 to 10 companies. The networks are designed to be “ecosystems” where boutiques can work together and where the technologies can be cross sold. For example, a network may comprise 7 companies all focused on AI. These networks are overseen by c.30 “Executive Partners” who are akin to a Sector CEO at Halma or a Portfolio Manager at Constellation Software. Executives Partners are responsible for sharing best practises and encouraging cross-pollination of clients and technologies. Executive Partners are not CEO’s looking over a Partner’s shoulder but rather “Board Members” holding Partners accountable.

In an ideal world, a new client with an intimate relationship with 1 boutique will get introduced to other boutiques and grow the relationship over time. Reply gives the example of BMW in Germany which started off as a medium-sized client of a single German boutique but today generates €18m of revenue across a dozen boutiques. Reply has made clear that they will never lower their margin just to generate a cross-sale. They are careful not to force a Partner to generate cross-sales, albeit Reply offers incentives of 10% of first-year revenue to Partner who refer business. I’ve identified 28 Executive Partners on LinkedIn. Most are veterans of Reply who have risen the ranks. What stands out is the average tenure is 18 years with Reply. Below are some examples of Executive Partners and their responsibilities per LinkedIn.

I am in charge to guide the strategies of Reply Group in Supply Chain, Manufacturing and Industry 4.0 based on our innovative proprietary SaaS platforms (LEA Reply, Click Reply, AXULUS, Brick Reply).

Enrico Nebuloni - Executive Partner at Reply

Managing the new Business Network "DATA & DIGITAL HUMANS" made of #8 Reply companies focused on DATA, Quantum, AI & GenAI

Marco Magagnini, Executive Partner at Reply

In charge of the business development, organization and control (delivery, cost, revenues) of several Reply companies, with roughly 600 professionals, with a vertical focus on innovative technologies and digital communication services on Italian market, cross industries (Finance, Telco, Media, Energy & Utility, Public Sector, Transportation).

Giuseppe Rossini, Executive Partner at Reply

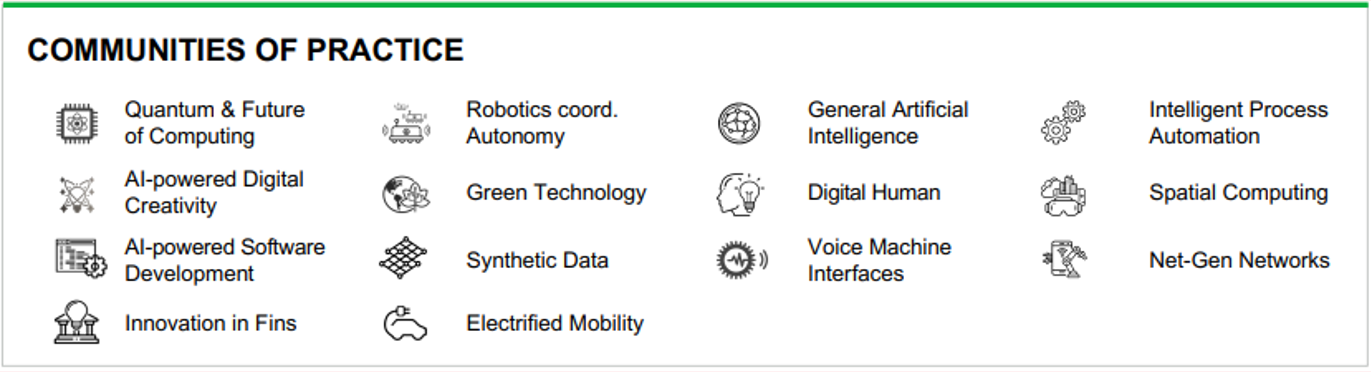

The table below gives a sense of the practice areas where some networks are clustered.

Reply does have c.10 centralized sales staff but they are not traditional salespeople. When multiple boutiques are doing business with a single client (i.e. c€70m of revenue with Stellantis across 20+ boutiques), the centralized salesperson is a shared resource that helps co-ordinate contracts, rate cards, legal agreements, deal with procurement, etc. That client’s main contacts are still the individual Partners. Reply bills each boutique 6% of revenue for shared services, which also includes HR and finance.

Decentralization fosters an entrepreneurial culture, accountability, and agility. By eliminating bureaucracy and time-consuming integration, everyone acts and behaves like entrepreneurial boutiques, which ultimately provide greater value to the end-customers.

Reply’s shared services model takes all the paperwork and admin away. This gives Partners full autonomy to focus on sales, R&D, and execution. In fact, Reply estimates that 90%+ of employees within a boutique are billable in contrast to 70% at most consultant firms.

Reply's decentralized model makes it highly scalable for M&A. Reply's model means entrepreneurs can sell to Reply and keep running their business autonomously. Reply has been able to retain approx. 2/3rd of the management teams it has acquired over in Italy and Germany (not in UK, will discuss more later).

Margins, not Growth

Reply incentivizes margins, not growth. This is one of Reply’s key insights. Bonuses for Partners are up to 60% of total compensation (i.e. 110% of base) of-which 70% is driven by hitting 20%+ boutique-level EBIT margins and only 10% driven by growth and 20% region specific targets (i.e. reduced DSO in Italy or reduced use of freelancers in the UK). The bonus can double by reaching 22.5% margins or be zero at 15% margins (ranges are tailored to the circumstances). Focusing on margins means 1) Partners focus on being first movers on the best and most cutting -edge technologies, 2) Partners are focused on keeping projects on-time and on-budget and 3) Partners are willing to disrupt themselves as technologies mature in order to sustain their high margins.

The last point is key as it allows partners to take short-term pain (lower revenue growth) for long-term gain. If a Partner works on a $0.5m project for a new SAP technology at 20% margins and that customer wants you to subsequently do a $3m project for a legacy SAP technology at 14% margins, Reply will turn-down that growth whereas most consultants will take on ever larger projects and figure out how to make the economics work by lowering costs and offshoring, leading to the eventual commoditization of the business. In fact, Reply is ok with boutiques going through several years of flat or declining growth as it cannibalizes itself and looks for a higher-value-added area of technology.

Margin focus ensures Reply is constantly disrupting itself. This is the opposite of all other IT-services companies. Mega companies like Accenture make upfront bets on technologies (say cloud or metaverse) which involve large investments like retraining 100k people. There is inherent technology risk. Reply on the other hand does not have to make any top-down bets. Rather, by having bottom-up incentives anchored to margins, the boutiques naturally gravitate towards the highest value-added activities. A former Reply partner told me Reply is great at “killing their business”. They know they have a 5 to 7-year window to earn high margins on a technology, and they are not interested in sticking around after because Reply knows that it will never have a competitive advantage on commoditized technology over larger or offshore competitors.

Growth is an outcome of margins, which is more sustainable longer-term. Competitors look at margins as an outcome of growth. They drive top-line headcount growth and try to improve margins by lowering SG&A/head. Reply is ok with boutiques going through 2-to-3-year periods of flat or declining growth as long as the boutique is identifying newer higher-margin areas to pursue because the margin incentives naturally orient businesses towards growth areas. Reply is now at a scale where with 230 boutiques, some are declining, others are accelerating, but in aggregate organic growth can sustain at 8% to 10%.

Local and Direct Delivery Philosophy

When it comes to specialised IT-services, Reply believes the person selling the service should be the one delivering the service. In a typical 8-person project team at large consultancy, you might have 5 engineers of-which some are in India and 3 project managers, i.e. MBAs who don’t understand the underlying technology. For Reply, that 8-person team will be comprised entirely of engineers. Reply’s Partners are the ones selling, developing and delivering the product. Reply estimates 90%+ of their employees are engineers and therefore billable in contrast to 70% at larger consulting firms. The issue for most competitors is that this model is not scalable as large contacts require some project management. But remember, Reply competes along a different vector. Reply is not trying to maximize revenue/project or revenue/client. Rather, Reply is trying to maximize the number of autonomous highly agile boutiques. This mindset and local delivery model has allowed Reply to scale this from 6 to 230 boutiques.

Reply’s sales model creates an execution and service advantage. As companies scale, they inevitably become more reliant on offshore engineers or need project managers and salespeople to interface with end-customers as they take on larger projects. The root cause of poor execution is typically when a non-engineer or an offshore engineer does not understand what they are selling or does not understand a technical speed bump. While Reply is giving up some upside by avoiding project managers and offshore engineers, which are essential for larger contracts, Reply is also ensuring that all of its projects have exceptional execution.

Reply has one of the most deliberate organizational models I’ve seen and within the context of a rapidly changing tech landscape, Reply’s model allows it to take relatively little tech risk and in fact, Reply does not need to be particularly pro-active in guiding the technological roadmap one-way or another. It happens naturally. Reply’s model is ultimately designed to be scalable. By scaling boutiques, Reply is maximizing the advantages of being a boutique while minimizing boutique risks. It is not the highest-growth model, but Reply is willing to trade-off growth in order to sustain its competitive advantages and sustain growth for longer without running into technology disruption or lower margins. This is part of the reason why Reply is exceptionally well positioned to take advantage of the tidal wave of consulting projects related to GenAI. However, with all models, there are multiple puts and takes.

In the next section, I’ll detail:

- Drawbacks of Reply’s Model

- Investment Thesis Summary

- Business Overview

- Region 1: Deep Dive on Italy and US

- Region 2: Deep Dive on Germany

- Region 3: Deep Dive on UK, France and Benelux

- Customers and End-Markets

- Management & Capital Allocation

- Key Risks

- Historical Financials

- Key Drivers and Valuation