Deep Dive: Diploma plc (DPLM)

Serial acquirer of niche distribution businesses

For those that read my deep dive on Judges Scientific, the basic idea was 1) Judges has a great track record 2) Judges has reinforced its management with people from Halma (also great track record) and 3) Judges is small so has a long runway.

I first looked at Diploma in 2020. The issue was Diploma had a great track record but in 2019-20, both the CEO and CFO, the primary drivers of capital allocation, left and Diploma did not have a “platform” that ensured the continuity of strategy and capital allocation as illustrated by a botched new-CEO hire (Richard Ingram) who was let go after 4 months. The subsequent CEO, Johnny Thompson, was unproven. However, since Johnny took the reigns in February 2019, his track record has been exceptional. Moreover, Johnny has taken steps to develop sustainable platform value. As a result, I believe Diploma’s next 10 years can be better than its last 10 years.

Diploma is a UK-based serial acquirer of value-added distributors focused on niche end-markets favoring specialization and service. Diploma has 100+ independent subsidiaries in 3 unrelated markets: Seals, Controls, and Life Sciences. The Seals Sector distributes seals, gaskets and hydraulic products used in everything from construction machinery, coffee machines, and fuel pumps. The Controls Sector distributes electrical wires, casings, fasteners, and harnesses used in everything from data centers, airplanes, to Formula 1 cars. The Life Sciences Sector distributes diagnostics equipment and related consumables primarily to clinics, labs, and hospitals. Over the last 10 years, Diploma has grown organic revenue 6% cagr, total revenue 16% cagr, EBITA 18% cagr and EPS 15% cagr. Pre-Tax ROIC on Total Capital has averaged 21% while Pre-Tax ROIC on Tangible Capital has averaged 87%, illustrating that Diploma is intrinsically a services business.

Investment Thesis Summary

- Diploma's end-markets are well-suited to the "platform" strategy. Diploma acquires distributors of high-margin niche products in fragmented end-markets where specialization and service are more important to price, which allows Diploma's niche businesses to earn 20%+ EBITA margins and very high returns on tangible capital. When Diploma acquires these businesses, they benefit from light integration, capital, mentorship, and Diploma's vertical expertise while largely retaining their original brand, management, and entrepreneurial culture.

- Diploma has multiple avenues where it can deploy capital. While Diploma is £1.3bn in revenue, the revenues are split between 3 unrelated verticals. This creates diversification. Moreover, it allows for capital allocation optionality and extends the runway where Diploma can do high-ROIC smaller deals across 3 seperate verticals. As a result, I believe Diploma should be able to sustain a redeployment rate of c.50% of FCFE at mid-teens returns for the next 10 years.

- Diploma has conservative guardrails. When doing M&A, Diploma has clear guardrails around business quality, organic growth (5%+), margins (20%+) and ROIC (high-teens pre-tax) and in-fact Diploma’s economics have improved over-time. Moreover, Diploma has committed to <2.0x leverage minimizing "blow-up" risk.

- Diploma's new CEO (joined 2019) is exceptional. When Johnny Thompson took over as CEO in February 2019, it was unclear what direction he would take but the operational and financial execution since he joined has been exceptional. Moreover, Johnny has taken steps to develop sustainable platform value (more on this later).

Generally speaking, I do not expect companies in my deep dives to be actionable.

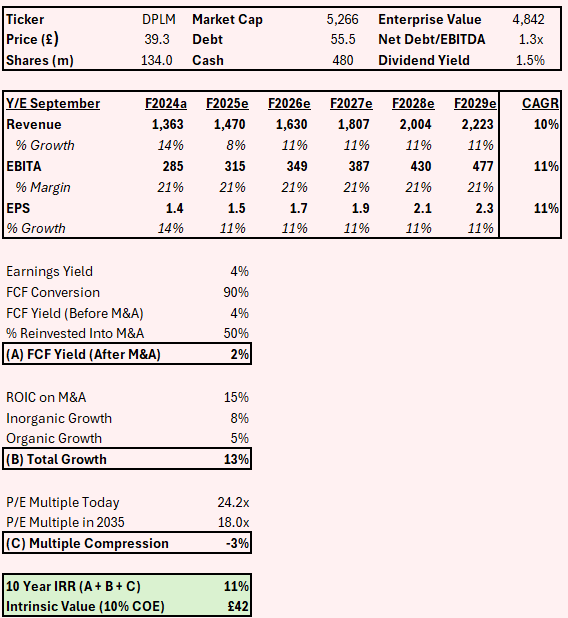

- Diploma is reasonably valued. Assuming they can redeploy 50% of FCF at a 15% post-tax return and sustain 5% organic growth, I get to a 11% IRR or £42/share intrinsic value assuming a 10% cost of equity and 18x terminal P/E multiple. Diploma’s businesses compete on specialization and service rather than scale so there are no obvious margin expansion opportunities beyond 2024 levels so I assume minimal operating leverage. A 50% redeployment rate implies each of the 3 Sectors will have to redeploy roughly £50m annually by 2030 which is achievable with mostly small bolt-on deals.

- A buy price of £30/share implies a P/E of 18x which offers a 14% IRR with reasonable assumptions.

- There is upside optionality. First, since Johnny took over, organic growth is trending closer to 6% than 5% and the sectorization and processes put in place may help sustain organic growth in the 6%+ range. Second, Diploma has proven it can be opportunistic with M&A as witnessed by Windy City Wire. To the extent large opportunistic deals come up, there is room for significantly greater than 50% of FCF to be redeployed assuming some leverage is used. Finally, 18x is likely too low of an exit multiple as Diploma will continue to have M&A opportunities well into the 2030’s and Johnny has built out the platform which should minimize succession risk longer term.

Organizational Evolution

The former CEO Bruce Thompson (1996-2018) was the architect behind Diploma’s strategy of acquiring niche high-margin distributors then managing them in a decentralized structure. Bruce was joined by CFO, Nigel Lingwood (2001-2020), for most of his tenure and together, they led strategy and capital allocation. Bruce was a highly adept capital allocator who, during his tenure, executed on c.30 deals. In the 10 years leading up to Bruce's retirement, Diploma sustained pre-tax ROIC of 26%. The issue is Bruce never put in place a strong platform around M&A and sector management that could scale beyond Diploma's relatively small size.

When Bruce retired, the board felt that a CEO with plc experience was needed and hired Richard Ingram, then CEO of Smiths Group (c.£3bn revenue at the time). Richard immediately clashed with managers. The board, recognizing their mistake, fired him after 4 months. Diploma then hired Johnny Thompson (aged 51) in February 2019. Johnny joined from Compass where he was previously CFO. I knew little about Compass, an outsourced catering company, at the time but have since learned that Compass has pursued an acquisitive and decentralized strategy that has consistently outperformed peers.

When Johnny first joined, it was unclear to me what direction he would take. This concern was exacerbated by the retirement of the CFO and the fact that both the CEO and CFO chose not to remain on Diploma's board (although they did join the board of other plc's). This led to concern that 1) new management would not be able to sustain M&A and 2) Diploma's culture or secret sauce could change. The fact that there were no internal candidates for both the CEO and CFO illustrate the fact that Diploma was still dependent on a handful of executives and did not have a real “platform”. Finally, within 9 months of hiring, Diploma acquired Windy City for £357m, its largest deal ever at its highest multiple ever (10.5x EBITDA) and issued equity to fund the deal, which put further concern that the disciplined M&A strategy would change (these were my concerns, but shares rallied on the WCW news).

What does Diploma look like today?

We now have a 5-year sample size to see how Diploma has evolved. As I will describe, Windy City delivered exceptional financial returns. Moreover, Johnny has taken several steps to build Diploma's platform leading to a more sustainable runway for M&A and a broader and deeper bench of future talent.

Johnny double downed on decentralization. Decentralization was critical to attracting potential sellers and scaling M&A which is why the Board made the right decision firing Richard Ingram. To illustrate the importance of decentralization, approx. 2/3rd of original management of acquired companies were retained as of 2023, something that would not have been possible with integrations. Johnny re-affirmed Diploma's commitment to decentralization and made it a core tenant of Diploma's culture. This is made obvious and clear in the 2024 annual report.

"Our decentralised business model, characterised by its entrepreneurial spirit, accountability, and exceptional leadership, has been instrumental in delivering such a strong financial performance"

David Lowden - Chair of Board

"These results reflect the strength of our value-add distribution model and diversified portfolio, but they are delivered by 3,600 accountable, customer-centric people, thriving in our decentralised culture."

Johnny Thompson - CEO

"Capability and culture are critical enablers of our ongoing scaling journey. Our decentralised and lean organisation, coupled with our growth, places particular emphasis on the people agenda. We work hard to preserve our decentralised structure and local ownership, prizing minimal organisation layers to avoid bureaucracy and ensure agility of execution."

Donna Catley - Group HR Director

Johnny Built Platform Value. Decentralization enables a nimble and entrepreneurial culture where MD's are empowered to make decisions. Johnny has taken this to the next level by evolving Diploma from an "accumulator" to a "platform". The main change (which directly addresses my original concern) was a focus on developing a pipeline of leaders. Johnny formalized the creation of 5 Sector CEOs, mostly recruited externally. Sector CEOs are charged with implementing the "Leadership at Scale" program which focuses on developing functional capabilities including sales and supply chain expertise within each business. The program mimics Halma and is comprised of sharing of best practices, proactive mentorship and regular workshops where learning and collaboration is encouraged. As Diploma evolves, Sector CEOs and CFOs should provide a pipeline for future HQ CEO/CFO’s mitigating succession risk. While it is too early to tell, the impact of Sector CEOs has allowed Diploma to upgrade their long-term organic growth model from 5% to 6%.

High Volume of Small Deals. In the past, M&A was led by the CEO, CFO and 1 or 2 corporate development directors. While capital allocation is still centralized at HQ, Johnny has done significant work to make M&A more scalable. Diploma now has a Head of Corporate Development supported by at least 4 experienced VP's who in turn are supported by at least 4 managers (per LinkedIn) focused on different sectors. While large deals are still done at HQ, per the Head of Corporate Development at the 2023 investor day, "we have significantly accelerated deal flow with a more strategic, proactive and structured approach." Since Johnny joined in February 2019, Diploma has done a significant 41 deals, which is a 50%+ increase in subsidiaries. If you exclude larger deals above £30m, Diploma has spent £171m doing 33 smaller deals with an average deal size of £5.2m. These deals totalled £150m in pro-forma revenue. Assuming a 20% EBIT margin, the average EBITA multiple on these deals was <6x EBIT. Moreover, Diploma disclosed in their F2024 results that they have 3,000 deals in their database with 50 in near-term active discussions, so there is a very long runway for high-volume/low-value deals to continue.

Strong Execution on Large Deals. In addition to the accelerated volume of small deals, Johnny has proven adept at identifying and executing on larger deals. If this is sustainable, it significantly increases upside optionality. Frankly, I was nervous about Johnny doing the largest deal in Diploma’s history so soon after he joined, but digging into the details, WCW was strategically and financially a huge success. Since 2019, Diploma has in aggregate deployed £1.1bn in 9 larger deals valued at £30m+. While most would assume ROIC on larger deals are lower, this isn’t necessarily the case. Based on disclosures, we can get a sense of how the larger deals have performed.

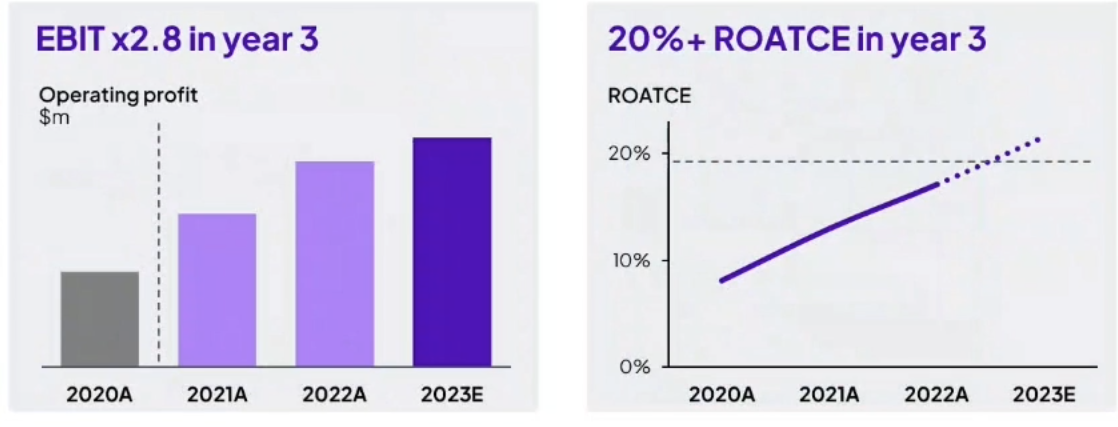

- 2020 Windy City Wires (Controls – US – £357m). Windy City Wires ("WCW") was Diploma's largest acquisition. WCW is a niche distributor of low voltage cable and wire. WCW was acquired opportunistically during COVID fears. While Diploma was not the highest bidder, Diploma won the deal because it allowed the Founder/CEO to continue managing the business autonomously (he is his own Sector CEO). While Diploma paid 10.5x EBITDA, WCW had grown EBITDA 13% cagr over the last 10 years. Since acquiring WCW in 2020, WCW has almost tripled EBIT allowing Diploma to achieve their 20%+ ROIC hurdle within 3 years. If WCW can sustain double digit growth, this may end up pencilling out comfortably to a mid-20%+ post-tax IRR. Financially, this was clearly a huge success. The deal was funded by leveraging up to 2x and issuing £190m of equity at £17/share which was an implied P/E multiple of 22x. While I would have preferred more leverage and/or a dividend cut, the share issuance happened at a reasonable valuation.

- 2022 R&G (Seals – UK - £100m). R&G is a distributor of industrial and hydraulic hoses, fittings, and assemblies, as well as compressors, seals, gaskets, and flange insulation kits primarily in the UK. End-markets include pharma, agriculture, F&B, infrastructure, construction, marine, and chemicals. R&G was bought via auction process from private equity. Management was retained. R&G is comparable to Diploma’s North American Industrial OEM business, so a business Diploma knew intimately, and gave Diploma a strong foothold in the UK market. Diploma paid an estimated 9.5x EBIT for a business with comparable growth and margins to Diploma but post-deal, Diploma indicated in their 2023 CMD that they’ve already increased organic revenue by 15% and total revenue by 28% by doing 5 bolt-on deals since 2021. Assuming 15% organic growth in 2023 and 5% growth in 2024, Diploma paid <8x 2024 EBIT for a platform business that has already done 5 bolt-on deals.

- 2023 TIE (Controls - US – £76m). TIE is a Nashville-based distributor of aftermarket interconnect products used in industrial automation with a focus on robotic and CNC machines from OEMs like Fanuc, ABB, Mitsubishi, and Siemens. TIE distributes parts in the post-warranty phase for machines anywhere from 5 to 25 years old and carries 100k parts for 250 equipment platforms. Diploma paid an estimated 9.8x EBIT. TIE was growing mid-teens and was margin accretive operating at 24% EBITA margins. While Diploma was only levered at 1.5x and could have funded this deal with leverage, Diploma announced a £236m equity raise (7% dilution) as part of the deal citing a stronger than usual M&A pipeline including 50 potential medium-term opportunities with a combined EV of £800m resulting in net-leverage post-deal of 0.6x. TIE’s management continue to run this business. Assuming a HSD organic growth can be sustained, this should pencil out into a high-teens returns.

- 2023 DICSA (Seals – Spain - £170m). 4 months following the TIE equity raise, Diploma acquired DICSA, a Spanish distributor of aftermarket fluid power solutions such as hydraulic hoses, fitting, and hydraulic components into Spain, France, and Germany. Diploma paid an estimated 9x EBITDA for DICSA, which had 23% EBITDA margins and was growing double-digits organically. Diploma retained DICSA’s management and leverage was 1x post-deal. Assuming HSD growth can be sustained, this should also pencil out into a high-teens returns.

- 2024 Peerless Aerospace (Controls - US - £236m). Peerless, Diploma's second largest acquisition, is a US distributor of specialty fasteners used in the an airplane's airframe. Peerless primarily distributes to Tier 2 suppliers. Management was retained in the deal. Peerless was growing at 9% cagr organically at an accretive 30% EBIT margin with Diploma paying an estimated 7x EBIT for the deal, a surprisingly low multiple for a larger, higher-margin, and higher-growth business. When asked about this on a call, management said Diploma was not the highest bidder and Diploma's ability to provide a permanent home for Peerless and Diploma’s ability to grow Peerless into the European market via potential synergies with Diploma's Clarendon business was why Diploma won the deal. If HSD growth is sustainable, this can comfortably pencil out to a high-teens post-tax IRR.

While larger deals should have lower ROIC, the two largest deals have a clear path to generate a 20%+ pre-tax ROIC or better and the other large deals all seem to have been growing double digits, so assuming HSD/LDD growth is sustainable, should also hurdle comfortably so it is hard to argue with the large deal track record. The main concern is that Diploma has been more willing to issue shares to do these large deals, albeit both issuances happened at reasonable valuations. The issuances end up to about 2% cagr dilution over the last 10 years.

In the next section (behind paywall), I will detail:

- Organizational structure, management, and capital allocation approach

- Seals Sector Deep Dive

- Controls Sector Deep Dive

- Life Sciences Sector Deep Dive

- Review the Key Risks

- Valuation and Key Assumptions

- Historical Financials

- Projected Financials