Deep Dive: Judges Scientific plc (JDG)

Serial acquirer of niche scientific instruments businesses

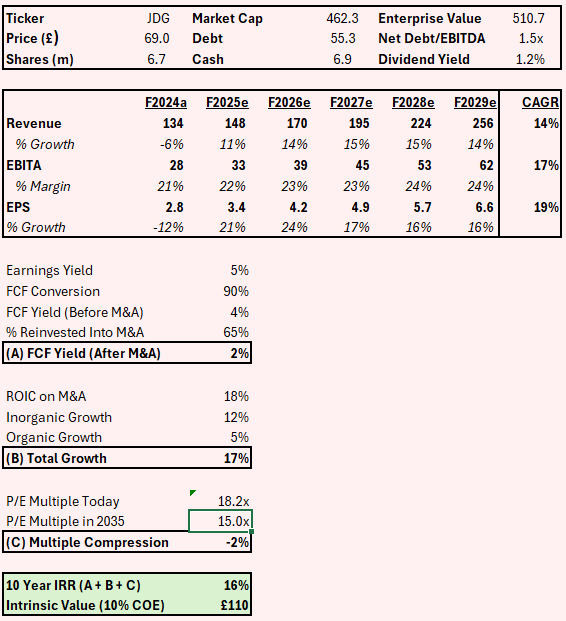

Judges Scientific is a serial acquirer of scientific instrument businesses with a long organic and inorganic growth runway. At today’s price, Judges can compound 16% cagr using conservative assumptions. I think 20% cagr over 10 years is possible if Judges can execute at a high level. While most of my deep dives will not be actionable right away, I believe Judges is actionable today.

Investment Thesis Summary

Proven Record. Over the last 10 years, Judges has deployed 100% of FCF into M&A averaging 24% ROIC on total capital. In addition, Judges has grown organically at 5% cagr at a 39% ROIC on tangible capital, demonstrating the inherent differentiation of the products Judges sells.

Exceptional Capital Allocation. Judges’ CEO is disciplined, has a proven track record, has skin in the game (10% ownership), has built a strong team including two ex-Halma execs, and has created an entrepreneurial culture and decentralized structure that can scale.

Cheap on reasonable M&A assumptions. Judges is small enough that it can redeploy 100% of capital at 18% returns for the foreseeable future. At £69/share You are paying 18x P/E and 20x FCF for a business that should compound FCF high-teens for the next 10 years. Intrinsic value assuming 5% organic growth and 65% of FCF reinvested in M&A at an 18% ROIC is £110/share. This increases significantly if Judges can sustain a 20x+ P/E multiple (Halma is currently 28x) or if Judges can redeploy 100% of capital, like it has over the last 10 years.

Short-Term Headwinds don’t impact LT thesis drivers. Judges is facing headwinds including lower R&D spending in China and the US and lumpiness in one of its large subsidiaries, Geotek. These headwinds are temporary and do not impact the core thesis driver, which is M&A.

Background

Judges Scientific is a UK-based serial acquirer of niche scientific instruments businesses. These instruments are used in a range of testing and measurement applications by universities, R&D departments and labs focused on life sciences/semis (~55%), geotechnical (~20%) and industrial (~25%) end-markets. Growth is driven by spending on education and R&D which is secular, and is diversified by subsidiary, as evidenced by the fact that only 2020 saw any meaningful organic decline. Revenue is diversified across North America (28%), Europe (25%), China (14%), UK (11%) and ROW (23%).

Judges was originally an investment vehicle called Judges Capital founded by David Cicurel (CEO) and Alex Hambro (Chair but retiring) and listed on the AIM in 2003. Judges’ initial strategy was to acquire small undervalued public companies, initiate a shake-up then encourage a sale to private equity. The UK small cap index nearly doubled from 2003 to 2005 making the strategy unviable. David began looking at different types of deals and found one that was particularly interesting. This business ended up being FTT, a Halma-like business focused on fire safety.

“It had £3m turnover and £750,000 operating profit, with 19 staff. It looked too good to be true. The owners were an engineer and a scientist, who were both looking to retire. They explained they had a dominating position in a tiny world niche and that the drivers of the business were regulation and globalization”.

David Cicurel in the Telegraph in December 2013

Following FTT, Judges pivoted to a buy-and-build strategy and began to exclusively focus on niche scientific instruments and has done 25 acquisitions since 2005. From 2014-23, Judges generated £101m in free cash flow and deployed £102m in M&A and paid £40m in dividends while average 24% returns on capital resulting in 25% EPS cagr. While Judges will leverage up to 3x, leverage has averaged <1x throughout this period and Judges has sustained a 30% payout ratio. Over the last 10 years, shares have compounded at 17.7% cagr dividends reinvested. At the current price, I believe 16% IRR is possible with even higher IRR with strong execution.

Why is Judges a successful serial acquirer?

Decentralization. Judges is a proponent of decentralization. While Judges requires strong financial controls and may help hire a controller, they do not require an ERP upgrade, do not target synergies, and they try not to meddle. This is on full display per this Judges’ video targeted at future sellers, which interviews subsidiary MDs. Rather, Judges provides value via capital, mentorship, shared used capabilities, and relief on back office functions. While synergies could create short-term benefits, they inhibit the scalability of the serial acquirer model longer-term as integrations make acquirers less appealing to potential sellers and adds bureaucracy making it harder to scale acquisitions. Short-sighted companies succumb to the temptation of synergies, but going down this path has long-term consequences to the sustainability of M&A. Judges has a long-term mindset and has made clear that they plan on sticking to their decentralized model.

Attractive End-Markets. Judges focuses on niche end-markets where a small company can be a leader in their field. These subsidiaries do not benefit from scale and typically already operate with 20%+ EBIT margins. This end-market is particularly attractive for the "accumulator" serial acquirer strategy where Judges can acquire companies that are already leaders but supplement growth by recruiting new salespeople, introducing new distributor relationships, facilitating expansion into new geographies and providing mentorship to optimize W/C, R&D, S&M, and G&A. There are an estimated 2,000 scientific instruments companies in the UK alone of-which ~200 have £5m+ in revenue. These companies are typically founder-led and last 20+ years before the founder retires, providing a steady stream of targets. Given their small size, Judges has acquired these businesses in the 3x to 7x EBIT range.

Strong Capital Allocator. David has skin in the game (10% ownership) and is a disciplined capital allocator. He is willing to step back from M&A entirely but also lean-into M&A, depending on the environment. David has studied the greats like Berkshire Hathaway, Halma, and Constellation Software. 10 years ago, the thesis was reliant on David. Today, David has built a deep bench of talent with the hiring of Mark Lavelle as COO in 2017 (17-years at Halma, former head of M&A), Tim Prestige as Business Development Director in 2023 (14 years at Renishaw, 8 years at Halma), and Ian Wilcox as Group Commercial Director in 2024 (Renishaw, Experian, Danaher, Oxford Instrument). Judges appeals to these experienced executives for several reasons. First, David has created a culture that empowers people to do their jobs without bureaucracy. Second, there is an appeal to leaving a large company to join an entrepreneurial mini-Halma with more organic and M&A runway. Finally, Judges is an AIM-listed company which has the additional benefit of having zero estate tax (vs. 40% above £325k otherwise), which may appeal to some executives.

Organizational Structure

The root of a serial acquirer strategy is the organizational structure. A roll-up like Berry Global or Couche Tard needs to be laser focused on integrations and cost synergies to succeed whereas an accumulator or platform needs to be committed to decentralization to attract potential sellers and scale the number of subsidiaries.

Judges has a highly decentralized organizational structure. Judges has a 5-person head-office comprised of the CEO, CFO, COO, Group Business Development Director (“GBDD”) and a Group Commercial Director (“GCD”). This head office manages 25 subsidiaries, each with an MD. The COO and GCD are "Sector CEOs". They oversee a cluster of ~15 subsidiaries loosely organized by scientific specialty. Their role is to mentor MDs and help optimize R&D, S&M and G&A, usually in pursuit of growth opportunities rather than cost savings.

Judges for example encourages higher spending on R&D, especially as it can diversify this risk across multiple subsidiaries. R&D typically goes from 4% to 6% of revenue (similar playbook to Halma). Many targets were historically run by scientists so simple initiatives like hiring a new Sales Director, doubling down on product development, or undertaking forgone capital projects, can have <1 year paybacks. The COO pointed out that there were dozens of £50k projects where the payback might be 3 months.

The businesses we tend to acquire are generally retirement sales and consequently have been used to being in a slightly more low risk environment because the owners are very keen to keep a successful business. When the businesses join Judges, we tend to take a higher risk view of investment in the business, particularly when we look at R&D where we spend across the group 5% to 6% of revenue investing in new product development. New products generate revenue growth, so we have a good track record helping businesses grow since they join our group.

Sector CEO’s visit each company every 4 to 6 weeks and run 1-week leadership workshops twice a year with MDs. These workshops are modelled off Halma and are designed to provide leadership training, foster a collaborative culture and to benchmark businesses on good/better/best metrics to find areas for improvement. The most obvious improvements are hiring new salespeople or finding new distributors, but it could also mean reallocating resources or finding capital efficiencies. You can see noticeable improvements to margins and working capital since Mark Lavelle took over in 2017, despite problems at 2 large subsidiaries (more specifics later). Judges is also developing shared use capabilities, which should improve as Judges scales. Using these capabilities are encouraged but not forced.

I think another benefit of the group is that occasionally there are initiatives that are too big for one company to do. So if you are a company with 12 or 15 people, its ok to send someone to the US or someone to Europe but China is pretty scary. There are situations where we have a group of companies clubbing together and opening a small office in China between them, which any one of them may find too intimidating. They can share legal costs and accounting. Again, this is something we encourage but not force.

The decentralized organizational structure combined with proactive mentoring, shared use capabilities, and de-risking of capital and R&D investments makes Judges an attractive permanent home to potential sellers and gives Judges significant opportunities to accelerate organic growth.

If there is a criticism, it is that Judges is not aggressive enough. Judges prefers its MD’s stay for the long-term. MD’s get a high base and a small bonus that might be 25% of salary based on custom metrics, the reasoning being that most MD’s are scientists who are incentivized by the product itself rather than purely financial goals. This may change over time with the COO in favor of more aggressive targets. Halma for example has bonuses that can be 150%+ of base for MD’s and they replace managers if they don’t meet aggressive financial goals, usually 20%+ EBIT margins and 10% growth.

The next sections include detailed reviews of:

Acquisition Strategy

Financial Track Record

M&A Track Record

Subsidiary-Level Track Record

Key Risks

Valuation and Buy Price

Subsidiary Level Overview

Management & Board

Access to PDF of Report