Primer: I.T. Services Industry

Deep dive on the IT Services Industry

This primer is a prelude to my deep dive of Reply SpA, which will follow next week.

Industry Primer

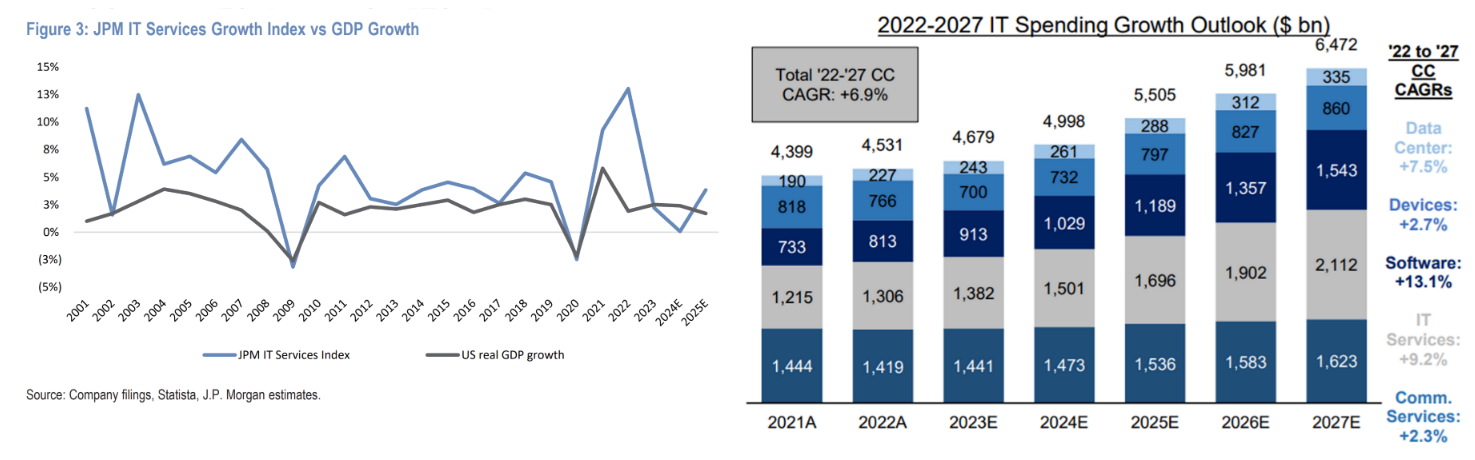

I.T. is a massive $4.3tn global market broken into hardware (50%), services (30%) and software (20%) and broken geographically into North America (40%), Europe (30%), Asia and ROW (30%). The market has consistently outgrown GDP by 1% to 2% driven by the need for all companies in all industries to leverage technology and digitize. Moreover, the market has tended to decline less than GDP during downturns and bounce back quickly.

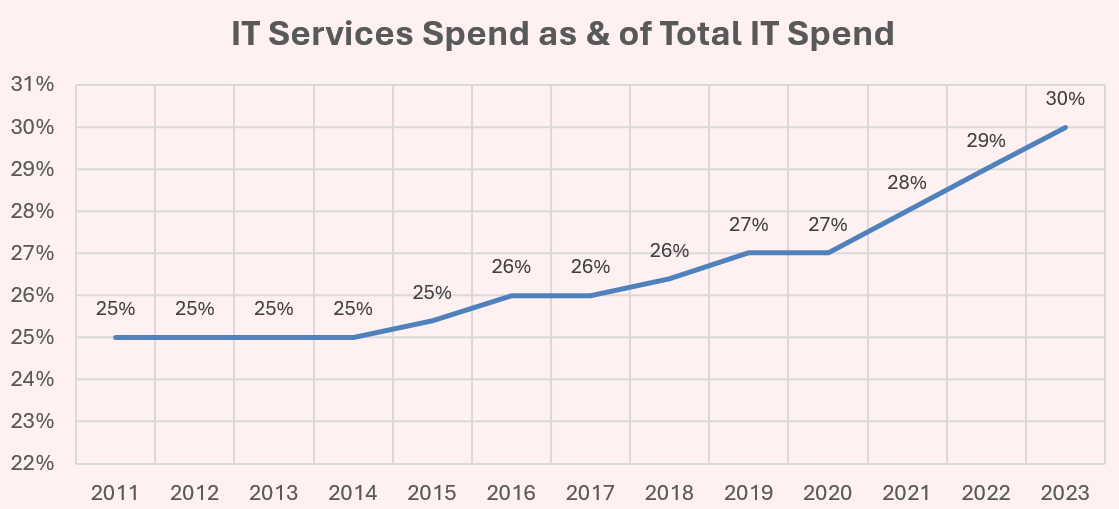

IT Services is massive sub-segment at $1.3tn, which has outgrown overall IT spend. Simplistically, IT services is everything required to help customers design, build, and run their IT stack. As IT becomes mission critical to companies in all industries of all sizes, it has become increasingly difficult managing this complexity in-house. This has increased IT services intensity from 25% to 30% of total IT spend over the last decade (per Gartner).

The $1.3tn market is growing MSD/HSD cagr, faster than overall IT spending. In the decade pre-COVID, IT-services spend averaged between 100bps to 250bps above GDP growth. This accelerated during COVID where IT services growth was HSD/LDD due to pull-forward of digitization spending. We are now in the digestion period where services spending seems to be bottoming out after normalizing post-COVID. IT spending tends to be resilient as companies can defer spend but cannot cancel spending as IT is mission critical. While discrete consulting projects tend to be the most cyclical, most IT services players saw <5% organic declines during 2008-09, roughly in-line with GDP growth, illustrating how mission critical IT spending is.

Why look at IT services?

There are several reasons.

- Secular Tailwinds. The industry has consistently outgrown global GDP driven by secular trends like digitization and complexity. There remains a very long runway for this to continue.

- Capital Light and Durable. IT services are a people-business so are capital light. Moreover, the main cost is labour which is variable leading to resilient margins through cycles.

- Qualitative Moats. Moats are qualitative and harder to understand from looking at pure financials, leaving room for discerning analysts to generate differentiated insights.

What are the different types of IT Services?

There are several ways to break down the pie. The more useful breakdown is based on functional areas. I'll start with some basic definitions.

IT Services can be divided into Application Management (software) and Infrastructure Management (hardware).

- Software (50% of IT Services Spend) relates to the design, building, and running of databases, enterprise applications such as CRM, ERP, HR systems, etc. as well as vertical specific software like supply chain management or core banking software. Software tends to be higher growth as spending on software is often a growth driver rather than a cost centre.

- Hardware (50% of Services Spend) relates to the design, building, and running of data centres, networking equipment, communications equipment, computers, phones, etc. Hardware tends to be slower growth as its often a cost centre. Moreover, customers are increasingly moving their on-prem datacentres to the cloud, which drives hyperscaler growth but puts pressure on overall hardware sales.

A more useful way to think of IT Services is functionally, as “design, build and run”.

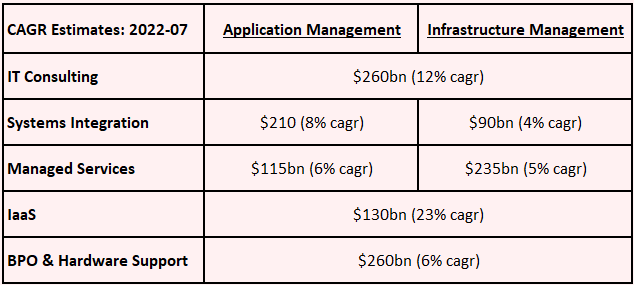

- Consulting (20% of Services TAM) involves helping companies "design" their IT strategy and architecture. These are highly strategic projects. Consultants deal with the C-Suite. The major players include the big 4 accounting firms, the big 3 strategy consultants, and large vertically scaled players like Accenture. Engagements are project-based, priced on time and materials, and last several months. Per Gartner, consulting is expected to grow 12% cagr from 2022-27, driven in part by companies exploring the potential use cases of GenAI.

- Systems Integration (25% of IT Services TAM) involves helping companies "build" or implement hardware and software solutions. Systems Integrators deal with IT departments. These can be quick 3 month implementations or projects lasting multiple years and costing hundreds of millions of dollars. Projects can be time and materials or fixed-price. For software, major players include Accenture with HSD share, Indian players like Tata and Cognizant with c.5% share followed by a long tail of other providers. For hardware, players include Kyndryl (formally IBM) with c.5% share followed by a tail which includes DXC, Atos, and Fujitsu. Per Gartner, systems integration is expected to grow 4% cagr for hardware and 7% for software from 2022-27.

- Managed Services (25% of IT Services TAM) involves helping companies "run" their IT systems. Cost is typically the major focus. Managed Services is often offshored. Contracts can last 5+ years and are fixed price or outcome-based. Per Gartner, managed services is expected to grow 4% cagr for hardware and 7% for software from 2022-27.

- IaaS (10% of IT Services TAM) which was previously embedded within the above 3 buckets, is now separately disclosed by Gartner. IaaS spending refers to spending on hyperscalers such as AWS, Azure, and GCP. IaaS spending has both a hardware component (servers, storage, networking), a software component (databases, middleware, tooling) and a managed services component (managing it all). Cloud penetration currently stands at 30% to 40% leaving a long runway for continued migration from on-prem systems. IaaS growth is expected to be 20%.

- BPO & Hardware Support (20% of IT Services TAM). This refers to fully outsourced business functions like outsourced customer support, outsourced IT, or outsourced finance and HR. Most IT consultants have moved up the value chain towards systems integration and consulting, with most of this BPO work being done by dedicated BPO specialists, like Genpact, WNX, EXL, or Concentrix, typically offshore.

Some Illustrative Examples:

- E.g. a large university may need a new HR and payroll systems provider. They will hire a consultant to do a 6 months project to understand their needs and vet software vendors. The consultant may then pass the project to their systems integration arm who, over 18 months, migrate legacy data onto a new database, configure the new HR system, and train staff on new policies and procedures. The university may have a tiny IT department so hire a managed services provider to maintain the system and act as an outsourced helpdesk to staff.

- E.g. a large consumer products company may decide they want an on-prem databases. This may be specific to EMEA to abide by privacy regulations. They may hire a consultant to help understand these regulations. A systems integrator will procure and install the servers and networking and integrate the datacentre with other datacentres creating a hybrid-cloud environment. Most enterprises outside of hyperscalers have limited knowledge of how to maintain a datacentre so will retain a managed services provider to manage the datacentre on an ongoing basis.

- E.g. a large financial institution may be running legacy core banking software. These systems are built on Fortran or COBAL. Given it is difficult sourcing coders with this skillset, they may retain a team of developers with an offshore provider to maintain this code base and update it for new regulations, new products, etc. while gradually upgrading to a modern core banking platform in select products or geographies.

- E.g. Accenture took over AIG's global shared services centre. Accenture assumed 6k headcount which covered finance, underwriting, claims, and IT services. Accenture then drove efficiencies using their in-house "SynOps" platform and leveraged this contract to cross-sell additional systems integration and consulting capabilities.

Understanding the Economics of IT-Services

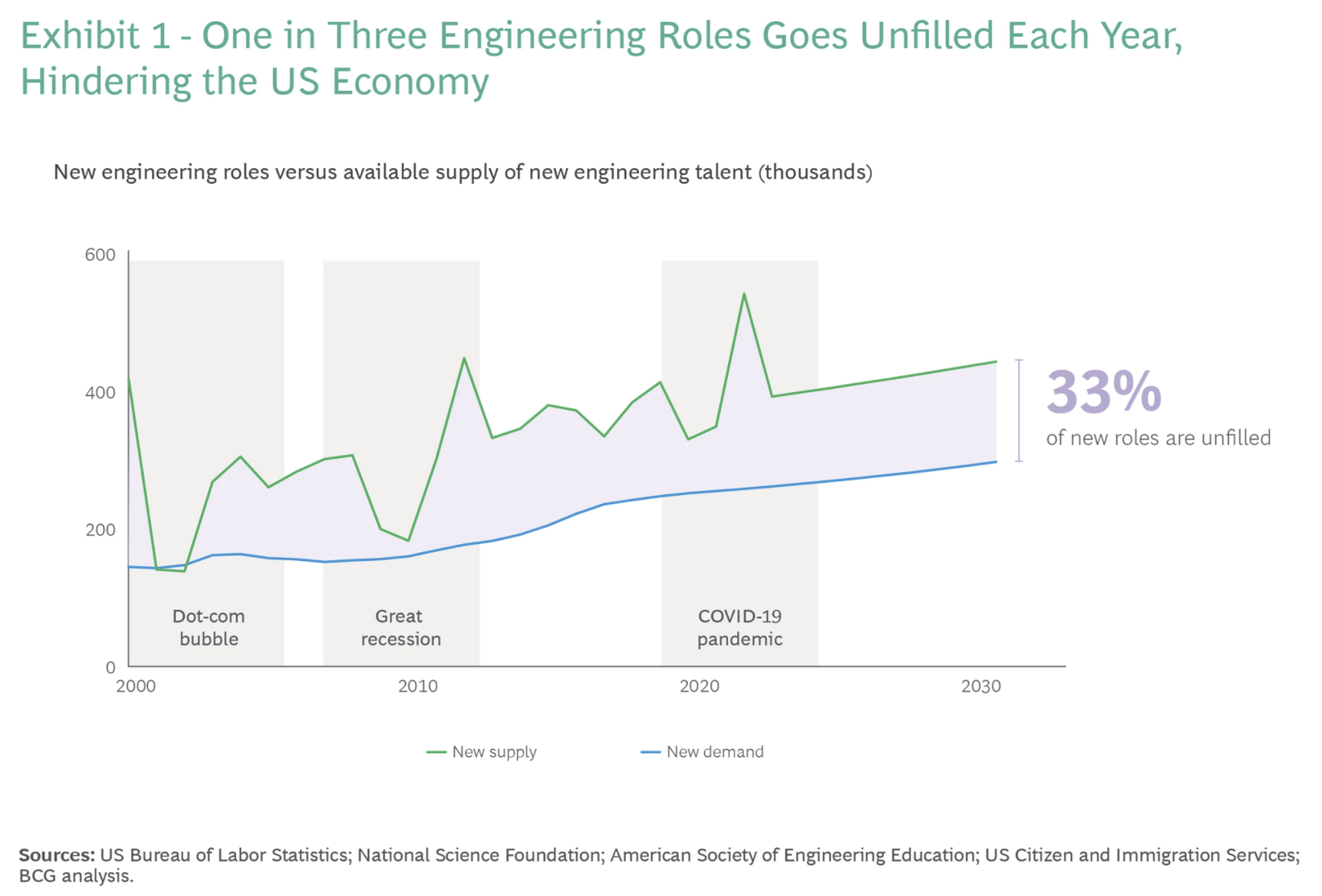

Simplistically, IT services companies rent out skilled labour. Why does this business model exist? Most enterprises outside of tech companies or mega enterprises can't retain a captive permanent pool of IT labour. This is particularly true given technology constantly changes which requires a constant refresh of the talent pool. You see similar trends in other industries. For example, it doesn’t make sense for large-cap biopharma companies to maintain a permanent pool of clinical trials specialists so they outsource to CROs. The problem is exacerbated by the structural shortage of skilled IT labour. Approx. 1/3 engineering roles in the US are unfilled and the issues is most acute with software engineers. Even big tech companies like Google with captive software talent supplement their in-house developers with consultants for projects (e.g. Google is a big client of Globant).

Because the business is "renting labour", the economics are simple.

Revenue = Headcount * Rate * Utilization. Long-Term growth is driven by an company's ability to 1) grow headcount 2) increase the chargeable rate or 3) drive higher utilization.

Costs = Headcount * Salaries * Utilization. Costs move in tandem with revenue but can be managed by offshoring to lower-cost countries or managing utilization rates by having disciplined cost control.

Based on the basic economics, there are a few variables where you can differentiate.

Headcount. Sustainable growth in headcount, all things equal, drives higher growth. Scale is a headwind. While Tata and Accenture have gone from 200k to 600k in headcount, it will likely be harder going from 600k to 1,800k without diluting talent. Smaller boutiques like Globant can get from <5k to 30k (23% cagr) but still have runway to get from 30k to 100k without overly diluting talent.

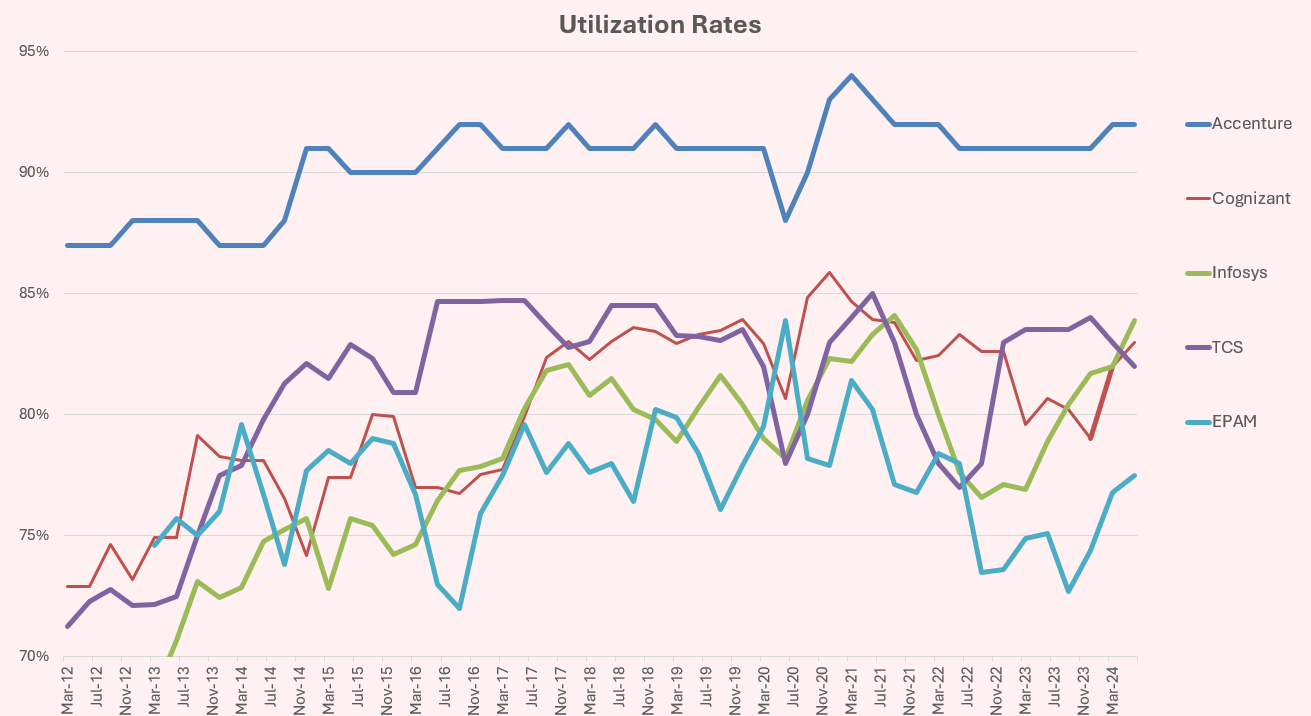

Utilization. Utilization is arguably a better indicator of moat. While 100% utilization implies a stale pool of talented and/or limited capacity for growth, a 70% utilization could indicate excess hiring or a lower quality labour force. Accenture stands out for consistently maintaining best in class 90%+ utilization. They can do this because they offer a one-stop-shop solution to mega enterprises and have a blend of faster-cycle consulting projects and longer-term systems integration or contractual managed services operations. The rest of the IT services industry runs between 75% to 85%.

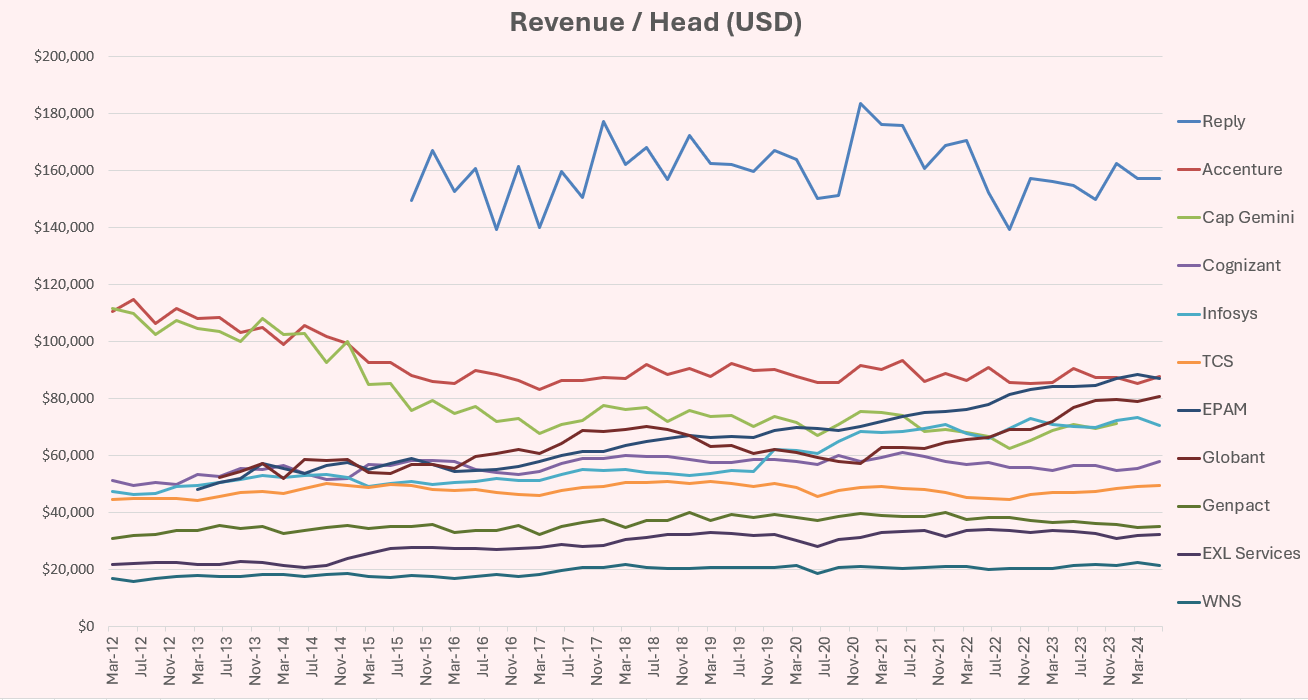

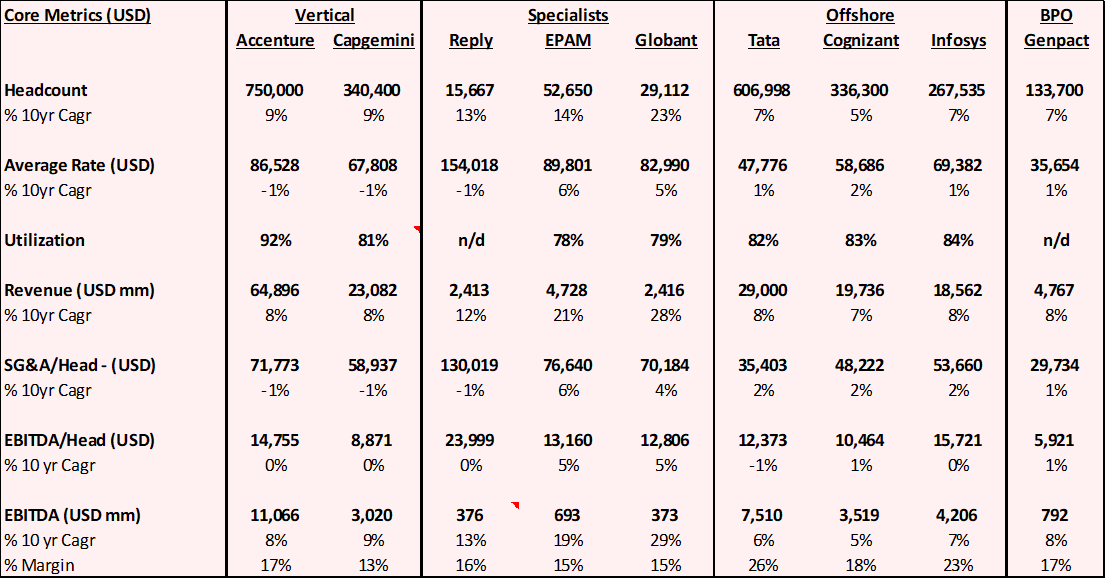

Rate. Some IT services players develop true expertise in cutting edge areas allowing them to charge a higher rate per employee. This might be expertise in areas like AI, cloud computing, or robotics or it may be industry expertise such as transportation or energy. In the table below, the main players that have achieved this are EPAM, Globant and Infosys who have all pushed average revenue/head higher. Both Globant and EPAM have pursued near-shore models focused on digital transformation allowing it to drive growth in their average rate over time. Accenture and Capgemini on the other hand started with a position of strength in consulting but layered on downstream services at a much lower revenue/head which drove average revenue/head down. Reply has a unique model which I'll detail in depth in my deep dive.

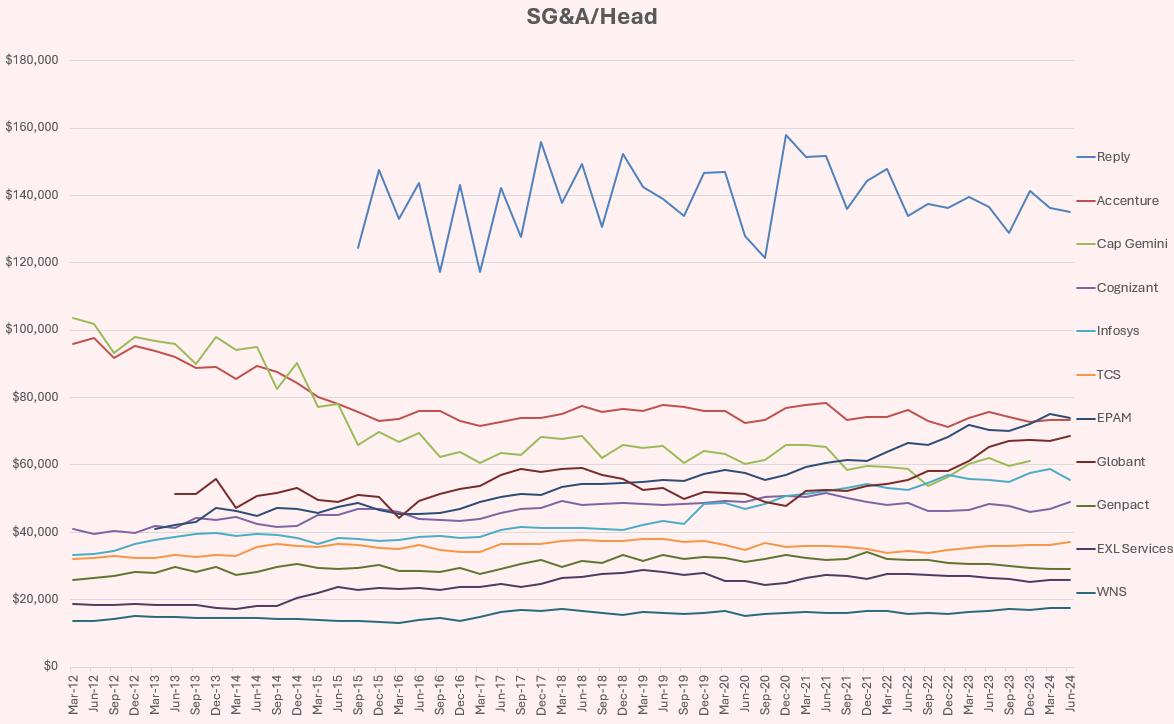

Salaries. BPO and managed services companies compete primarily on cost so a flat to declining SG&A/head is a good thing. The offshore players also have a cost-driven value proposition so declining SG&A/head is a good thing. On the other hand, specialists like EPAM and Globant are trying to compete on technical expertise. As a result, a rapidly declining SG&A/head is a sign of commoditization. Companies can aim to keep this ratio flat by generating attrition of expensive employees at the top of the pyramid whilst laying in younger employees, which is historically something vertically integrated players like Accenture do.

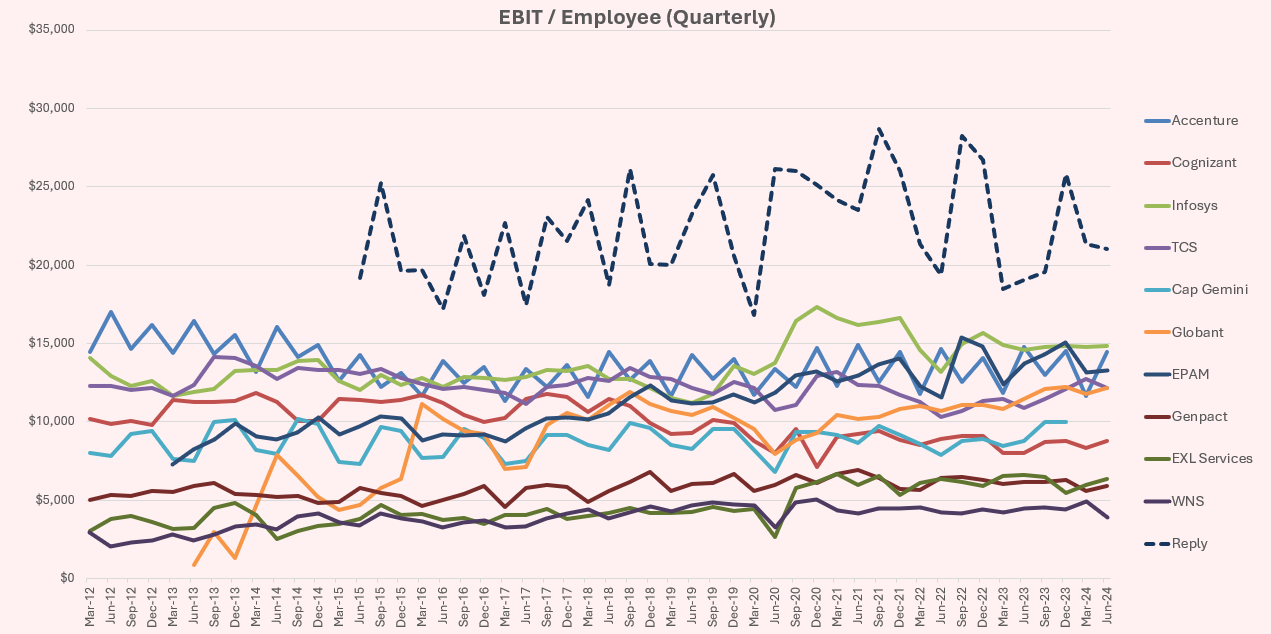

EBIT/Head. All of this translates to an EBIT/head. These are not capital intensive businesses so while a higher EBIT/Head is better, all things equal, what matters most is achieving a level of EBIT/head that can sustainably grow.

What are the different models of IT-services?

The market is fragmented owing to limited barriers to entry. The top 10 providers have c.25% share comprised of Accenture, Deloitte, PWC, and E&Y (3% to 6% share each) followed by Tata, IBM, NTT, Capgemini, Cognizant, and KPMG (c.1% to 2% share each) followed by a very long tail of other players.

Below is a summary of the different models. I don't have public financials for pure-play consultants like E&Y or KPMG. The interesting thing is that despite very different focus areas and delivery models, the vertical players, specialists, and offshore players all converge to roughly $10k to $15k in EBITDA/head. Reply is the exception, which I will describe in more detail later.

Vertically Scaled Model (Accenture, Capgemini, Deloitte)

Mega consultancies like Accenture and Capgemini play in all horizontal and vertical markets. They can design, build, and run the IT systems of the largest enterprises either onshore or offshore. For example, Accenture can do everything. Their revenue mix is 22% consulting, 49% systems integration, 15% managed services, and 13% BPO and their revenue mix is globally diversified. Their model is to start with consulting at the C-Suite then sell downstream services. Capgemini follows a similar model, but with less success.

The mega players have several advantages. First is reputation. Big IT projects are risky so going with a brand name is a way for a Board, a CEO or CTO to mitigate career risk. Nobody gets fired for hiring Accenture. Second is reference customers. Large implementations (think $50m+) will require strong references and the scaled players have the most references in the most technologies in the most geographies. Third is one-stop-shop. The scaled players have a greater ability to cross-sell and upsell services to their existing relationships, which tend to be Fortune 100.

There are also disadvantages to scale. The first is bureaucracy. Large players need additional management layers around technology, industry, and geography to help co-ordinate resources. Accenture for example has 46 people on their global management committee making it harder to be agile in the midst of a rapidly changing tech environment. Second is technology risks. Technology constantly evolves. Smaller and agile players can cannibalize themselves or pivot (i.e. EPAM went from 70% of workforce in Ukraine/Russia/Belarus to <30% in under a year) whereas this is harder to do on large managed services contracts. As a result, mega consultancies need to make top-down bets on vendors, technologies, and customers. This increases their exposure to technology risks and also means large players are often behind-the-curve on cutting edge technologies with nascent TAMs.

If there is a metric Accenture and Capgemini are optimizing for, it is probably higher Revenue/Client or higher EBITDA/client. While the number of clients is not explicitly disclosed, Accenture said in 2022 they had 156 clients doing $100m+ in revenue per quarter, which I believe is significantly higher than anybody else. While this is a valid strategy, it is worthwhile pointing out that increasing Revenue/Head is like pushing on a string. Accenture is already so large that the incremental cross sale will likely be dilutive to Revenue/Head. While Accenture still generates headcount growth above IT spending, Accenture is not significantly outgrowing the IT-services industry by increasing penetration with existing clients of lower-end services.

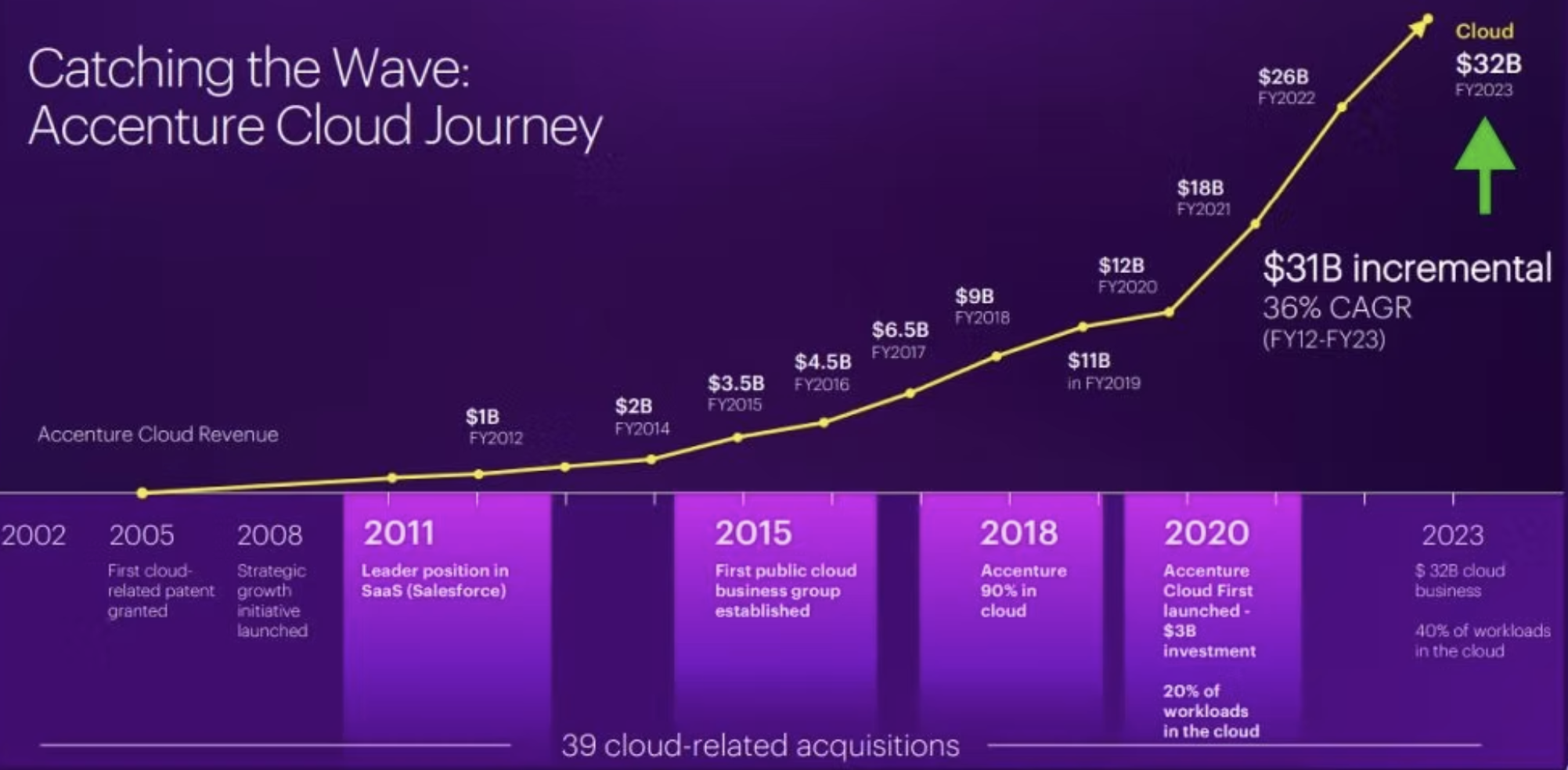

Accenture arguably does take on technology risk. Selling lower Revenue/Head service implies selling more commoditized services. Given their sheer scale, they have to invest upfront into training and upskilling their workforce on technologies like Cloud, Metaverse, or AI which could prove incorrect but their sheer scale also means it is unlikely they'll ever have to bet the farm on any single client, technology, geography, etc.

Specialized High Value Model

There are different types of specialists. Specialists include primarily onshore companies like the big 4 accounting and big 3 strategy firms that are 80%+ dedicated to consulting. While none of the major players are public, I used FTI Consulting as a proxy and they generate $400k+/employee and c.$50k/EBITDA per employee implying SG&A/employee of $350K. This is probably on the high-end as FTI does use a lot of independent contractors and experts, but directionally, the per-employee metrics are all high. These companies likely grow roughly in-line with the IT-services industry, with a potential medium-term boost from consulting around Gen AI.

Near-shore boutiques such as EPAM, Globant, Endava, Grid Dynamics, etc. have all grown significantly faster than IT services. Nearshore boutiques tend to focus on higher-value digital transformation. Given they are smaller in scale, they can often be more nimble and focus on more nascent technologies or smaller TAMs where it may be harder for Accenture to play. The near-shore value proposition is 1) lower costs to onshore and 2) higher value to offshore. This gets borne out in Revenue/Head that is 50% to 80% higher than offshore offset by SG&A that is also higher to offshore leading to almost exactly the same EBITDA/head.

The advantages and disadvantages of the nearshore model is the inverse of the vertically scaled model. Boutiques can be more nimble and build practices on relatively nascent technological areas. On the other hand, they don't have the same reference customers or reputation and mostly can't cross-sell or upsell to the same extent. While micro boutiques may bet the farm on a single vendor or application (say a consultancy dedicated to ServiceNow), most of the publicly traded boutiques are at a scale where they have reasonable diversification across vendors, applications, industries, etc.

Reply is a unique model where they are effectively 100% onshore and despite the much higher SG&A/head, can still deliver significant value to end-customers as reflected in the best-in-class EBIT/head. I'll detail Reply's model in my deep dive.

Horizontal Low Cost Model

Tata, Infosys, Cognizant, and Wipro are examples of offshore Indian firms. Offshore players can have labour rates that are 50%+ lower to onshore prices while charging prices that are 25% to 50% lower. Indian players like Infosys have leveraged their historic capabilities in managed services to move upstream into systems integration and consulting and have successful driven higher rates. Given their scale, the large Indian consultancies tend to grow at + or - 4% of IT services growth. These players optimize for costs so have the lowest SG&A/head in the industry, which in turn allows them to drive HSD revenue growth. Interestingly, the EBITDA per head between Accenture, EPAM, and Infosys all shake out to roughly the same, despite very different models.

The main advantage to offshore players is that they have access to massive labour forces meaning they can address the needs of mega corporations at reasonable costs. For example, mega insurance companies and mega banks who spend upwards of 6% of revenue or hundreds of millions on IT are all multi-decade clients of Indian offshore players. The main disadvantage is that the value-add can commoditize. The labour attrition rates can be 20% or even 30%+ and from a CEO or CTO perspective, they are often viewed as "bodies" rather than an Accenture that may be viewed as a strategic partner. There is also then argument that low-cost offshore is most at risk of disruption from AI as their capabilities are most commoditized.

Impact of Cloud on IT Services

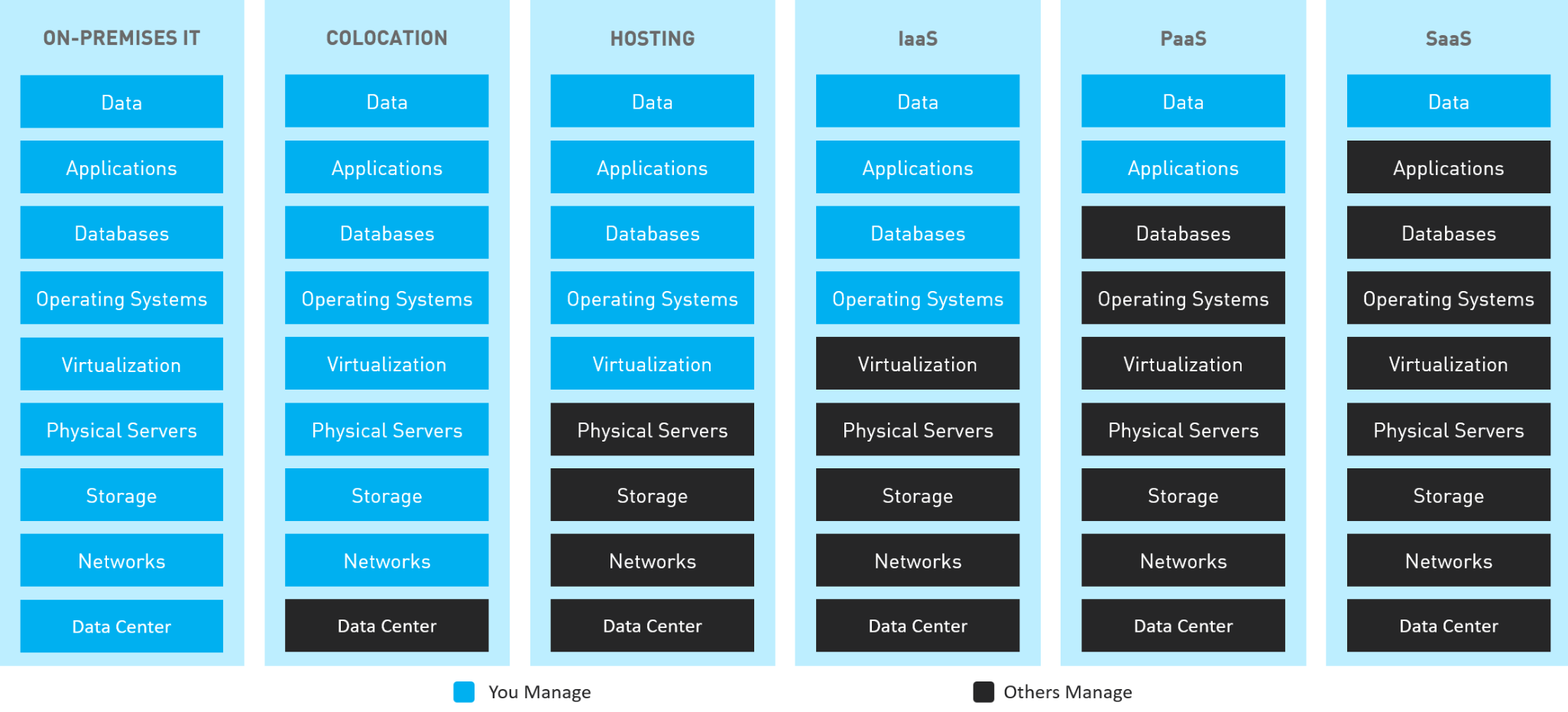

The basic theme in IT-services is that the vast majority of enterprises are not IT experts and therefore need help designing, building, and running their IT systems. New technologies, despite their promise of simplicity or more seamlessness, ultimately increase complexity and are a driver of growth. As the table from Check Point software shows, as on-prem IT systems migrate to the cloud, more and more of the software stack is progressively managed by the SaaS vendor or IaaS provider.

In the 2010's, this trend was perceived as an existential threat. The thought process was that as more of the IT stack went to hyperscalers, complexity would decrease thereby dampening growth in IT services. While cloud did impact growth in managed services for infrastructure (grew LSD the last decade), total IT spending continued to grow GDP+1% to 2% while IT-services related to cloud migrations and new SaaS applications was explosive.

There are several reasons why:

- Cloud introduced complexity. Enterprises had to make strategic decisions on whether to work use hybrid cloud or multi-cloud then undertake complex cloud migrations.

- Cloud facilitated an explosion in new SaaS applications. The barriers to entry for software start-ups were lowered leading to new cloud-first applications like Salesforce, Workday, and ServiceNow leading to significant growth.

- Hyperscalers don't have the services capability or desire. Hyperscalers are ultimately not services organization so cannot handhold enterprises through the cloud migration process, which is where IT services players come-in.

- IT is never simple. Once enterprises migrate to the cloud, they have new problems like how to leverage cloud to save costs or build custom applications. Accenture estimated only 18% of end-clients fully leverage their cloud capabilities.

Impact of Gen AI

On the negative side, similar to cloud, there will be some discrete verticals that will grow significantly slower. The areas that currently come to mind are certain managed services or BPO type businesses, which AI may cannibalize. It should be noted that this has been going on via earlier iterations of AI innovation, which used to be called robotics process automation, for the last decade. Accenture for example highlighted in their 2022 Investor Day that up to 25% of their workforce were bots allowing 35% of their operations people to move into higher value "expert roles".

Another risk is deflation in software developer rates. For example, while some already cite higher 20% to 30% higher productivity of coders (albeit this is mostly higher-end coders at tech start-ups) if this were to get into the 100%, 200% or 300% type range, the cost-led proposition of managed services provider would decrease. For example, HSBC may no longer need 10,000 offshore Indian developers when they can just have a nimble and agile team of 2,000 coders in London doing the same thing. A big assumption here is whether these changes drives HSBC to spend less on IT services overall or rather, HSBC chooses to allocate the budget towards other areas of IT-services. Were this scenario to play out, the IT-services companies themselves would also benefit from the 100% or 300% improvement to efficiency making their value proposition all the more compelling.

On the positive side, I believe the impact will be similar to cloud. Companies will need consulting to better understand how to leverage GenAI to either defend or grow their businesses. Als or the drive of the last 10 years towards robotic process automation, meaning it will be a catalyst for growth. GenAI is not "plug-and-play". Enterprises will need significant systems integration work to clean-up their data and migrate this to the cloud to make it easy to query. At a minimum, cloud migrations will likely accelerate as many of these LLM models will work best on a hyperscaler environment. There will be complexities associated with data governance and regulations which will result in significant complications. We are still in the early innings with GenAI revenue mostly limited to strategy consulting projects to better understand how AI can be leveraged.

Tickers

- Accenture - ACN

- Capgemini - CAP, CAP.FP

- EPAM

- GLOB

- DAVA

- GDYN

- Reply SpA - REY, REY.IM, REY.MI

- TCS.NS, TTNQY, TCSF

- CTSH